Kitsap’s Market: First Quarter, 2022

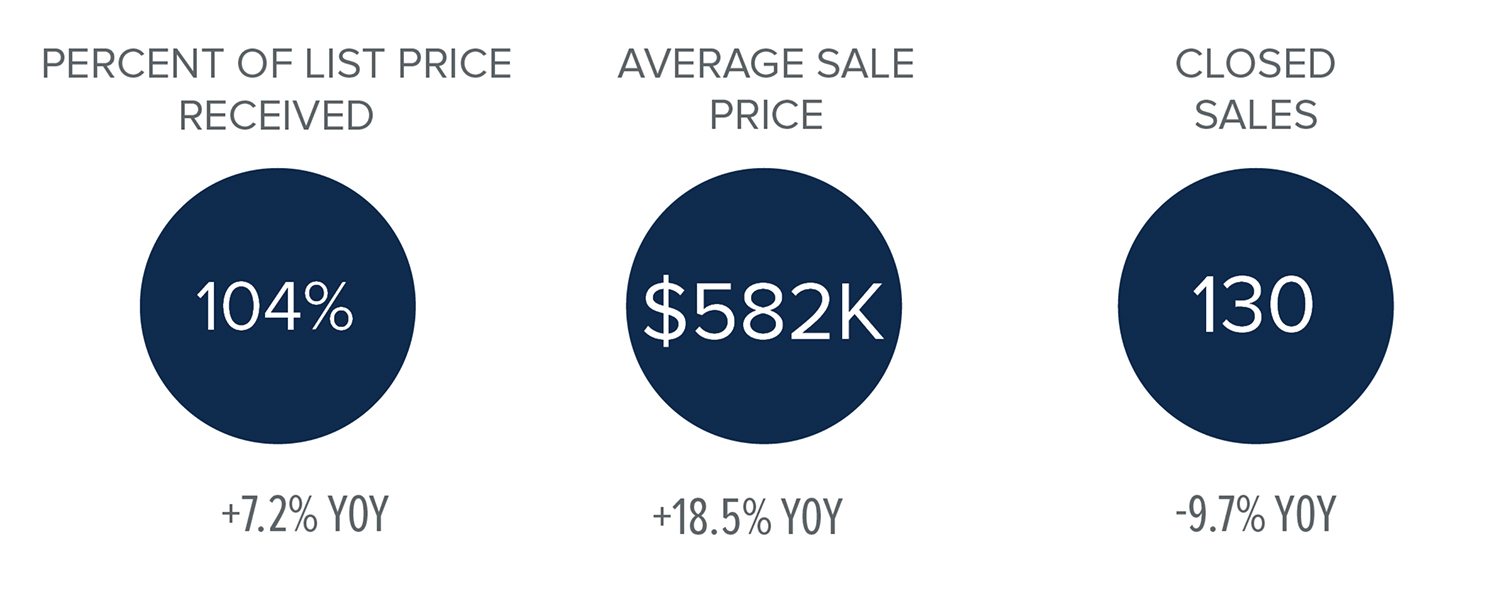

Kitsap County’s real estate market is picking up and had a solid first quarter. In 2021, we saw high demand and low inventory, and that is still the case. It’s still a seller’s market; homes continue to sell above the asking price. Read on for key highlights and market trends below. And, if you’re looking for the connected life that Kitsap offers, our local experts are here to help.

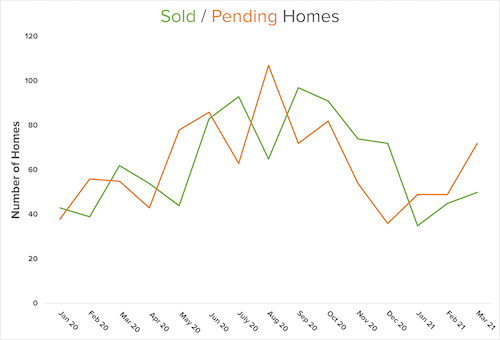

News on Sold and Pending Homes

2022’s first quarter is rising like the first quarter of 2021. You can see it reflected in the market volume graph outlined above. This follows the usual real estate market trend of a cooler first quarter and then a shift as the market heats up in warmer months. As usual in a seller’s market, sold homes still outpace pending listings and home prices are still increasing due to demand. From January through March, 994 homes were sold. That is a 10.7% increase when compared to 2021’s first quarter, showing more movement as the pandemic wanes.

Kitsap’s Market Still Favors Sellers

As supply remains low in relation to pre-Covid times, sellers can list with confidence. Buyers will need to be prepared for a competitive real estate journey. We expect more homes to come on the market as we hopefully put Covid-19 behind us.

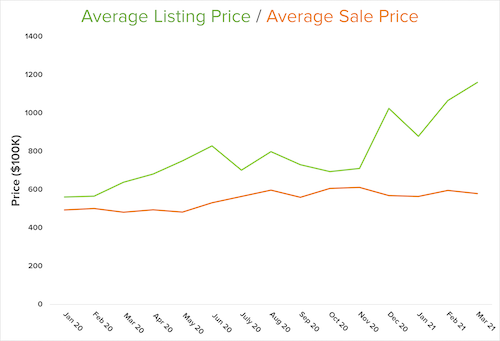

Listing Price vs. Sale Price

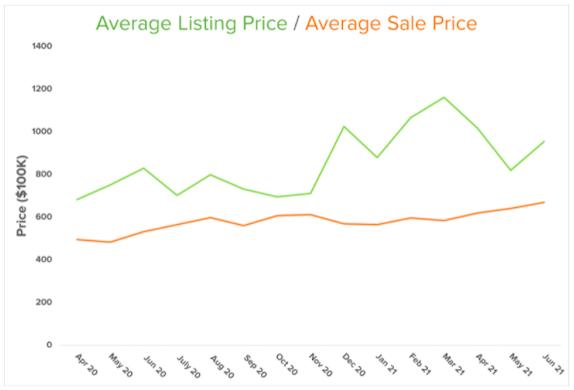

Kitsap’s market is still seeing many eager buyers and often competitive, multiple-offer situations. We saw a 10.8% increase in home prices year-over-year. They are expected to continue to rise as Kitsap’s market has many buyers who will continue to meet the pricing demands of sellers. However, we are continuing to see increasing affordability issues for others. The average sale price in Kitsap County is currently $606,000.

Insights from Our Chief Economist

Matthew Gardner, Windermere’s Chief Economist, shared his Top 10 Predictions for 2022 in one of his recent Monday with Matthew videos. Here’s what Gardner predicts for 2022:

- Prices will continue to rise, though the pace of appreciation will slow. Gardner thinks it will be about 6% in 2022 versus the massive 16% rise of 2021.

- Spring will be busier than expected. This will increase buyer demand, as buyers get more clarity in their new hybrid model combining remote and office work.

- The rise of the suburbs will also result from this work hybrid model. Many buyers are moving within the same area they already lived in.

- New construction jumps since the cost to build has come down.

- Zoning issues will be addressed.

- Climate change will impact where buyers live. People will focus more on how safe a location is in relation to natural disasters.

- Urban markets will bounce back after the demand drop from Covid.

- A resurgence in foreign investors will return since the travel bans were lifted last November. The demand will rise as long as our borders remain open.

- First-time buyers will be an even bigger factor in 2022. This year, 4.8 million millennials will turn 30, the median age of first-time buyers in the U.S. First-time buyers will be looking for cheaper markets.

- Forbearance will come to an end and that will be okay. It was well thought out, and as Gardner says, “as of recording this video, there are now fewer than 900,000 owners still in the program.” Hopefully, this continues to drop.

Additional Information

You can learn more from Matthew Gardner by reading his Market Update by region or watching his Monday with Matthew video series.

If you’re new to our area, check out our free Guide to Kitsap. If you’re interested in buying or selling, our local experts are here to help.

Fourth Quarter Market Review for Kitsap County

Wondering how Kitsap County’s real estate market did during 2021’s fourth quarter? We’ve compiled key highlights and insights to keep you up to date.

Just as in previous years, our local market slowed down during the holiday season. There are still many eager buyers looking to make Kitsap County their home, but fewer homes were for sale during the fourth quarter of last year. With continued low inventory, our market still favors sellers.

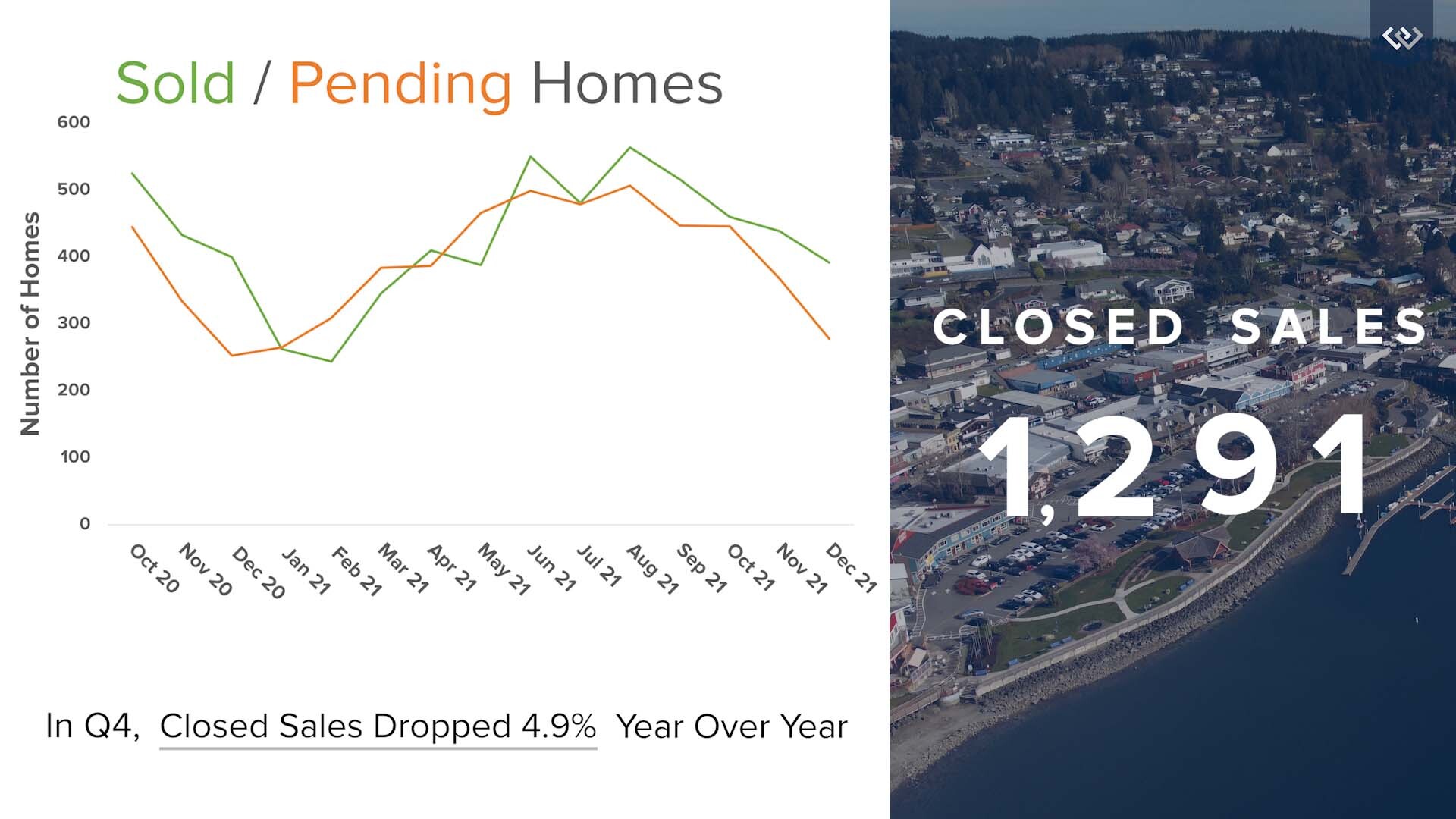

News on Sold and Pending Homes

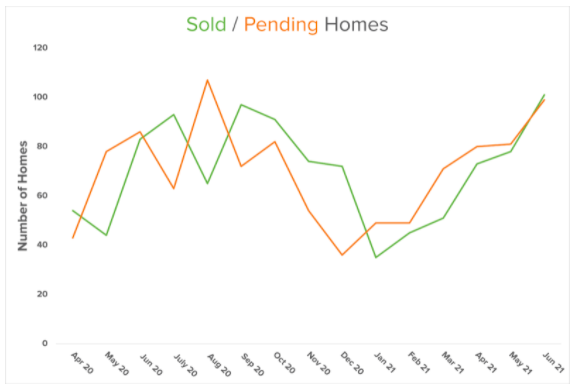

In the last five quarters outlined in the graph above, 2021’s real estate market started with the usual growth trend into the summer. Now, we’re seeing the seasonal downswing during colder months. However, home prices are still increasing due to persistent demand, and sold homes are still outpacing pending listings. The result is a strong seller’s market. In the 4th quarter of 2021, we had 1,291 closed sales, which is a 4.9% decrease, year over year.

Still a Strong Seller’s Market

Kitsap County’s real estate demand was very high during the fourth quarter of 2021. With the new era of remote work, many Seattle homebuyers are seeking the peaceful, connected lifestyle that Kitsap offers. If you want to learn more about our area, check out our free digital guide. If you’re interested in buying or selling, our local experts are here to help.

Kitsap County’s real estate demand was very high during the fourth quarter of 2021. With the new era of remote work, many Seattle homebuyers are seeking the peaceful, connected lifestyle that Kitsap offers. If you want to learn more about our area, check out our free digital guide. If you’re interested in buying or selling, our local experts are here to help.

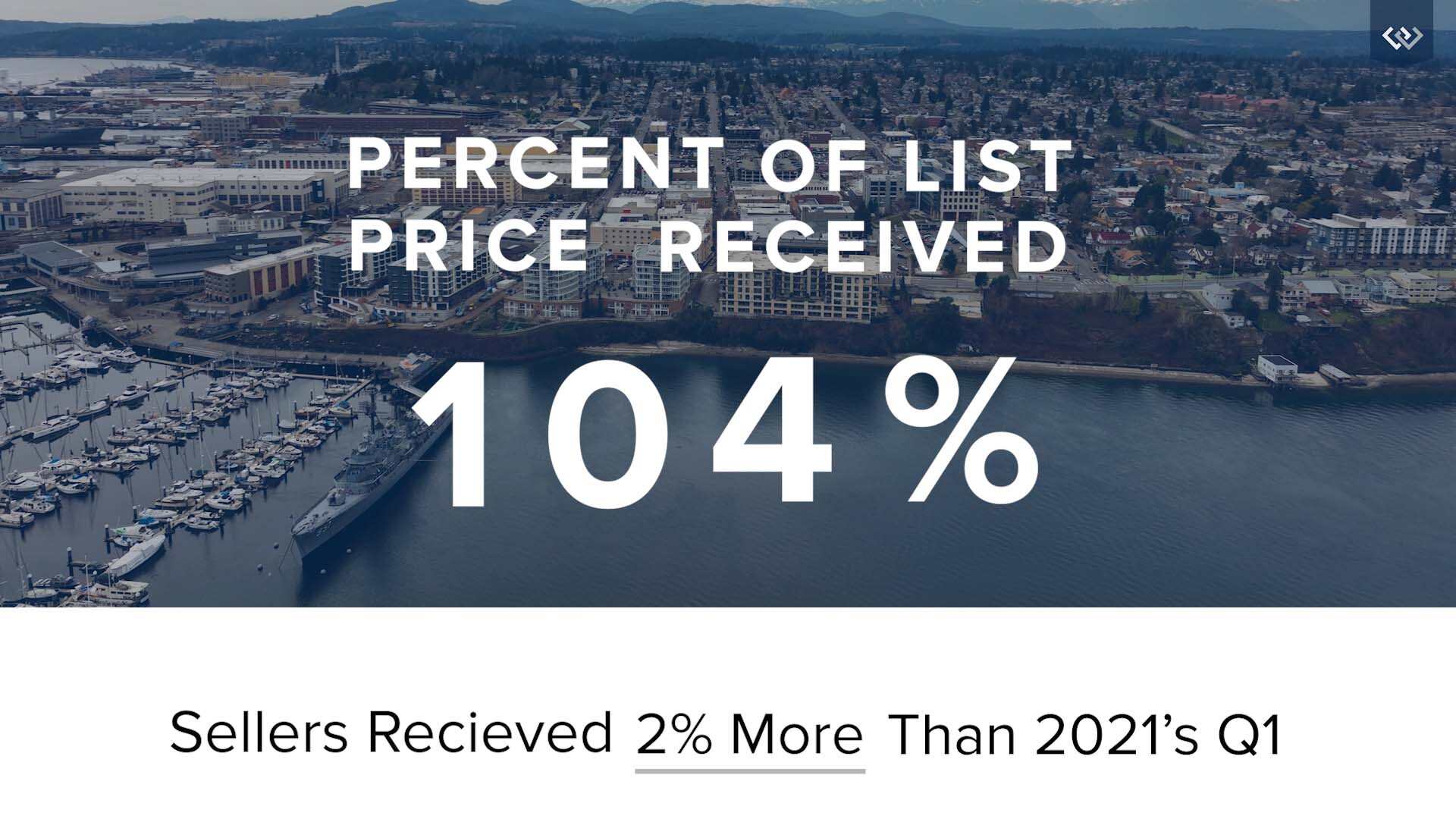

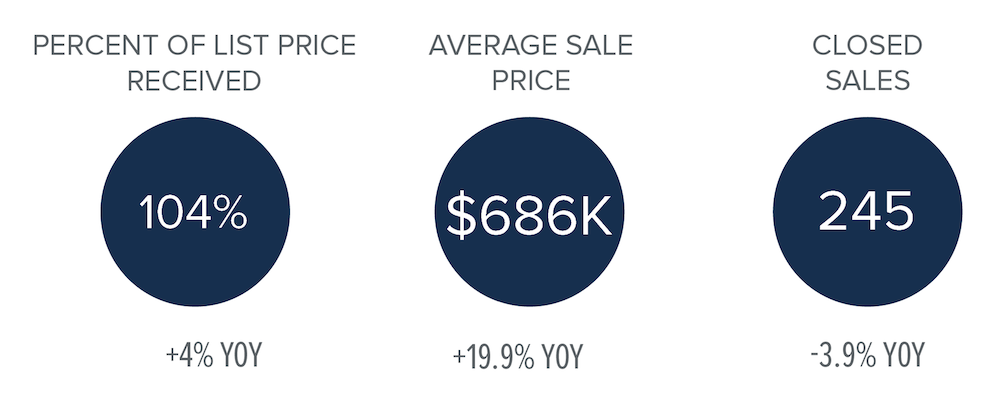

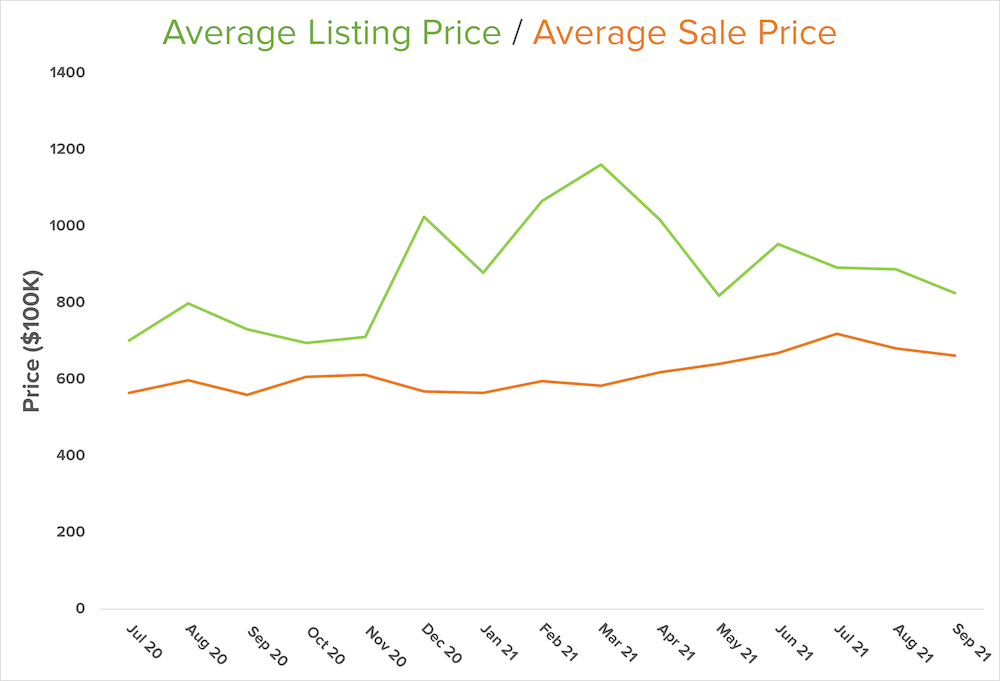

Listing Price vs. Sale Price

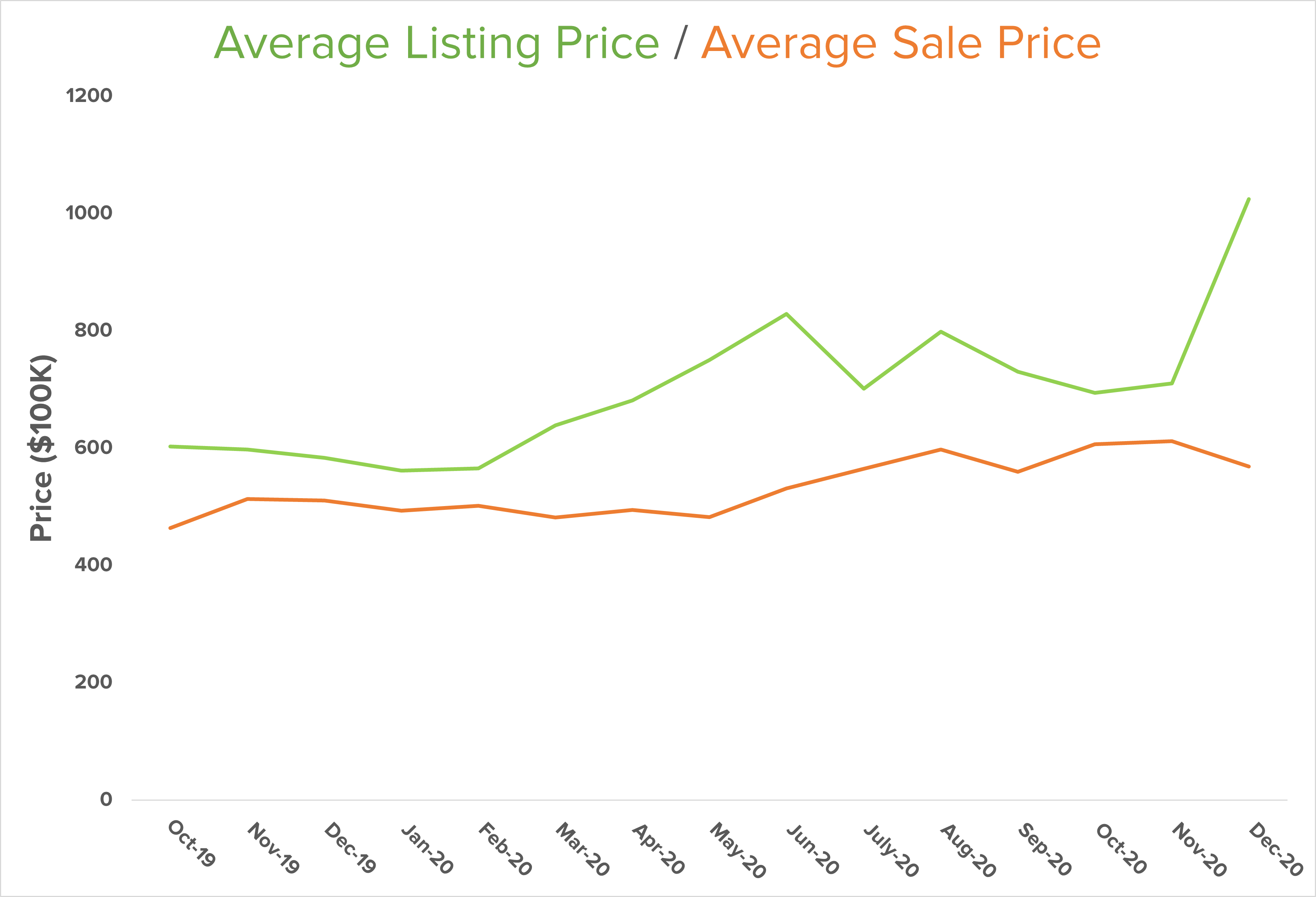

Although buyers continue to meet the pricing demands of sellers, there just aren’t enough homes available right now. As you can see in the graph above, the averages of listing and sale prices are starting to converge as demand pushes the cost of housing even further in favor of sellers. In our 4th quarter, we saw an 11.3% increase year over year in the average sale price in Kitsap County, putting it at $613,000. Affordability concerns have continued to be an important topic of discussion.

Insights from Our Chief Economist

Zooming out to look at the broader real estate market in our region, we have insights from Windermere’s Chief Economist, Matthew Gardner. In his most recent Monday with Matthew, Gardner shared his market forecast for the coming year: “If everything goes according to my plan, you should expect to see the housing market start to move towards some sort of balance next year, but I am afraid that it will still remain out of equilibrium until at least 2023.” This is an important reminder that the transition back to a balanced market will be a gradual shift.

While Gardner ensures us that he “doesn’t see a housing bubble forming,” he is concerned about housing affordability. There is definite cause for concern among the millennial generation as they start to settle down more and more. Millennials are currently the largest group in the generational real estate market, so it will be interesting to see where affordability and demand intersect.

Gardner concluded by saying, “demand for ownership housing remains remarkably buoyant and, in fact, it is quite likely that demand may actually increase with the work from home paradigm that will start to gain momentum next year.” In light of this dependable demand, real estate continues to be an excellent investment.

Why You May Need a Comparative Market Analysis

If you’re thinking of selling or wondering what your home is worth, a real estate agent can provide you with a Comparative Market Analysis (CMA). Not sure if you really need one? Read on to find out more.

Comparative Market Analysis

A CMA is an informative report with data that compares your property to similar properties in your local real estate market. In order to provide you with a Comparative Market Analysis, an agent will need to inspect your property. This doesn’t mean you need to hire professional cleaners as if you’re about to host an open house. You simply need to make sure your home is in good condition so that they can properly assess its condition and worth. It’s also a great time to let your agent know if you’re planning to make any changes before selling. If you don’t have an agent, our agents can provide a free analysis.

After an agent assesses your home, they will do some research to obtain data on similar properties in your area and examine regional market trends. While you can find this data through the Multiple Listing Service, a qualified, local agent will know much more, providing their local market expertise. For example, they may be familiar with the nuances of your area, recent transactions that went well or fell through there, and why. As a result, you will get a much more accurate picture than an online search would provide.

Your agent will be able to tell you how much your property is worth given the current market. Their analysis will account for all of the factors that go into pricing a home such as market conditions, location, and seasonality. They’ll discuss comparable homes or “comps” – properties with similar characteristics such as the same property size, condition, and square footage.

CMA vs. Appraisal

It’s important to note that a CMA is not an appraisal. An appraisal must be done by a licensed appraiser and is required by mortgage lenders. A bank appraiser does not have a vested interest in the sale of the home. They are there to determine your home’s fair market value. Their focus is on ensuring the bank isn’t lending the buyer more money than needed.

How a CMA Could Benefit You

If you really want to know what your home could potentially sell for right now, we highly recommend a Comparative Market Analysis. A CMA can help manage expectations and help you make informed decisions. A CMA can ensure accurate home pricing, keeping it competitive in the current market. You’ll know what homes in your area are selling for, how long they were on the market and the difference between their listing price and their sold price. You’ll be able to examine a low, medium, and high selling price for your property. Also, if you are upgrading or remodeling your home, a CMA could help you see if the changes you’re planning to make will really improve your property, setting it apart from others in your neighborhood.

Third Quarter Market Review for North Kitsap

Our North Kitsap real estate market has been even more competitive for buyers. Read on for key highlights from our strong third quarter and insights from Windermere’s Chief Economist, Matthew Gardner.

Our Competitive Market

North Kitsap’s inventory is now lower than last year while the demand remains high. Remote working culture seems here to stay, opening doors to the greener pastures of Kitsap living. These eager buyers outnumber sellers, which is reflected in the lower volume of closed sales when compared to this same time last year. Our Brokers continue to experience situations where some buyers are outbid either by price or by an all-cash offer. But if you’re looking to buy, don’t let that discourage you. From first-time buyers to seasoned investors, our local experts are here to guide you through this competitive market.

Market Data

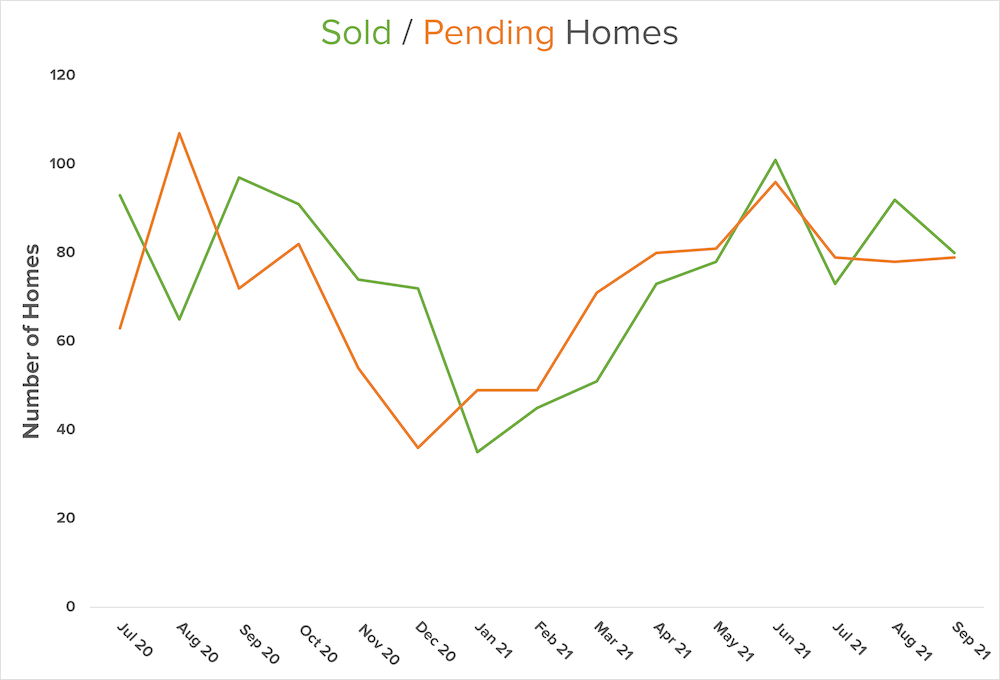

Looking at the last five quarters in the graph below, there is a noticeable plateau for this year’s third quarter when compared to 2020’s third quarter. But home prices are still increasing, and the amount of sold homes still outpace pending listings as a result of the increased demand. As we enter the slower season and inventory wanes further, prices may level, which will start to balance out the market. Or, it will at least start a shift in that direction.

Sale prices in North Kitsap remain strong. And, as you can see below, the listing and sale price divergence went through a slight correction in the second quarter of 2021, but it’s now back on track. Our agents are still sharing experiences with many eager buyers and many happy sellers due to the continuing demand and our strong seller’s market.

Home Purchase Sentiment Index: Insights from Matthew Gardner

In his most recent Monday with Matthew video, our Chief Economist delivered a comprehensive analysis of the most recent Home Purchase Sentiment Index figures put out by Fannie Mae. The data comes from a survey containing approximately 100 questions on housing-related topics. Fannie Mae collected 1,000 consumer responses from across the country. As Matthew Gardner says, “It’s the only national, monthly survey that’s focused primarily on housing.”

The survey shows that many Americans continue to think it is not a good time to buy because of the low supply and rapidly rising prices. However, many feel it is a good time to sell as consumers predict home prices and mortgage rates will go down. As Gardner explains, “most consumers continue to report that it’s a good time to sell a home, but a bad time to buy. They most frequently cite high home prices and a lack of supply as their primary rationale…However, the good time to buy component did tick up for the first time since March.” While this is a recipe to shift towards a buyer’s market, we’ll see how things unfold in the coming months.

Gardner sums it up nicely: “The takeaways for me so far are that consumers tempered both their recent pessimism about home buying conditions and their upward expectations of home price growth.” So again, we are seeing the potential for a shift toward a more balanced market.

Second Quarter Market Review for North Kitsap

Our North Kitsap market performed even better than expected during our second quarter. We’ve compiled key highlights so that you can easily stay informed about our local real estate market.

Our Strong Seller’s Market

North Kitsap’s inventory remains low and demand remains high. Many people are continuing to move out of bigger cities in part due to the remote working culture. There are still many eager buyers and fewer sellers. Our Brokers continue to experience situations where some buyers are outbid either by price or by an all-cash offer in this competitive market.

If you look at the last five quarters detailed in the graph below, you can see that growth trends in volume continue to rise, even when comparing 2020’s second quarter to 2021’s second quarter. And, our market is definitely heating up this summer.

We’re continuing to see even higher prices. As you can see below, the listing and sale price divergence is shrinking now, as sellers benefit from our inventory shortage, asking for higher prices. Many buyers are able to meet this demand and we’re still seeing low mortgage rates.

Market Insights from Matthew Gardner

In his most recent Monday with Matthew, our Chief Economist, Matthew Gardner, begins with the staggering fact that “prices have risen almost three-fold, as the cost to finance has dropped by 72%.” If the number sounds too good (or bad) to be true, that’s because it is. To get an accurate picture, you also have to factor in inflation. Gardner explains that “just like other goods and services, the price of a house today is not directly comparable to the price of that same house 30 years ago because of the long run influence of inflation.” When you adjust for inflation, the rise in housing prices becomes less drastic. Without adjusting for inflation, “prices have risen by 268%”. But when you adjust for inflation, the “real prices have increased by 83.6%”. Therefore, the increase is much lower than what most people are discussing today.

Matthew also compares mortgage payments, another important piece of the puzzle. Although, without adjusting for inflation, “mortgage payments have increased by 74.3%,” the inflation-adjusted “real payments are 10.7% lower!” Of course, there are other monthly payments associated with home ownership. This includes property taxes, which do not change with market fluctuations. But this still indicates “that prices have been able to rise so significantly because mortgage rates have dropped”. It’s also because “inflation-adjusted home prices really haven’t skyrocketed – contrary to popular opinion.”

However, Matthew clarifies saying, “there are some markets across the country where the picture isn’t quite as rosy. In these places, prices have risen significantly more than the national average.” The Seattle metropolitan subunit (which extends around our local area) is one of these places. This is largely due to the increasing affluence as a result of the tech boom.

Not a Housing Bubble

Gardner’s bottom line is this: “there are quantifiable reasons to believe that we are not in a national housing bubble today.” However, he does point out that some markets will see a slowdown in price growth given “where prices are today in concert with the spectre of rising mortgage rates.” Ultimately, it’s still a strong seller’s market with an overall low supply and high demand. We expect to continue to see issues with affordability as prices and mortgage rates continue to climb.

First Quarter Market Review for North Kitsap

Poulsbo’s North Kitsap market picked up in our first quarter despite a seasonal slowdown. We’ve compiled key highlights so that you can easily get informed about our local real estate market.

Our Strong Seller’s Market

North Kitsap’s inventory remains low and demand remains high due to people moving away from the bigger cities and COVID-19 changing the way we work. There are still many eager buyers outnumbering sellers. Our Brokers continue to experience situations where some buyers are outbid either by price or by an all-cash offer in this competitive market.

If you look at the last five quarters detailed in the graph below, you can see that a similar growth trend in volume is repeated when comparing 2020’s first quarter to 2021’s first quarter. Get ready for the market to continue to heat up as we move from spring to summer.

With our low supply, we may see even higher prices. This strong seller’s market is driving us toward an affordability ceiling. As you can see below, there’s a growing listing and sale price divergence. Sellers continue to benefit from our inventory shortage. Prices may soon be too high for some people to afford to buy a home here.

Affordability Issues and Market Insights

Matthew Gardner, Windermere’s Chief Economist, continues to track this affordability ceiling in his most recent Housing and Economic Update: “If the pace of home price growth continues, many households will start to be priced out” of what people can actually afford. As Gardner points out, we need more supply, and we need home prices to drop to alleviate this market strain.

Unfortunately, that might not happen fast enough for many hopeful homebuyers to make their dream a reality. Gardner reminds us that the cost of materials, recent storms, and the current housing market prices have all added to the cost of building new homes. This, in turn, will add to the listing price.

Additionally, Gardner points out that mortgage rates have risen after “a jump in bond yields has led rates to spike” as the country re-opens and economic activity increases. The resulting potential inflation causes the 10-year treasury interest rates to rise in hopes of attracting more buyers. However, it is still far below standard rates and shouldn’t be a concern for buyers right now.

Ultimately, it’s still a strong Seller’s Market with an overall low supply and high demand. We expect to continue to see issues with affordability as prices continue to climb.

New Agent Spotlight: Rebecca Olodort

We’re excited to feature new agent Rebecca Olodort. She knows how important it is to be a good listener, a strong advocate, and a trusted guide. Rebecca offers a wealth of information and experience and her love of home design and helping people shines through. Read on to find out more.

What unique professional experiences or skills do you possess that enhance your abilities as a Realtor?

I am a detail-oriented, practical, strategic problem-solver who ran a 50M fashion business for many years. Critical to being able to do this was: listening to all involved parties.

What drew you to real estate?

A passion for helping people combined with a love of home design.

What personality traits do you think are important in this profession?

It is critical that a Realtor be trustworthy, determined and a good listener. The ability to see all sides of a situation gives me the unique opportunity to create a smooth and seamless real estate transaction.

Which areas do you serve and what do you love about those areas?

I serve King, Kitsap, Jefferson, and Clallam Counties. We have the best of all worlds in hiking, boating, and access to downtown Seattle via ferry. I love hiking the many local trails. There are really too many to mention but I highly recommend Fort Lawton Trail, Lake Crescent, and North Kitsap Heritage Park. Our favorite restaurants in North Kitsap are Kingston Ale House, Streamliner Diner, and Burrata Bistro. Another fun day for us is taking the ferry to Seattle, visiting one of the many museums (especially the Seattle Art Museum), and having a bite to eat and a lovely glass of wine at Purple Café.

How long have you lived here?

I was born in Kansas, raised in southern California, and I’ve been living in the Pacific Northwest for over 10 years. We were looking for an area with a small town feel and access to a major city with an international airport. We moved to Kingston in 2016 to design and build our forever home. Simply said, we have the best of all worlds.

How are you involved in the community?

I’m a White Horse Golf Community Board Member and their Design Review Chair. Also, I’m a volunteer for Meals on Wheels of Kitsap.

What made you decide to work with Windermere?

After working for major corporations such as Estée Lauder, Swarovski, and Fossil Group, it was an organic decision to work with the most professional and successful real estate brokerage in the Pacific Northwest.

Is there anything else you’d like to share with us?

I enjoy shopping at Central Market and the local Farmers Market to select ingredients for preparing healthy meals for my husband and 96-year-old mother. In 2019, we adopted our Maltipoo, Sadie, from the Kitsap Humane Society and she is a 10-pound bundle of joy!

We are so glad to have Rebecca Olodort as a new member of our Windermere team. She’s a sincere pleasure to work with and you can connect with her on Facebook and Instagram, or visit her website.

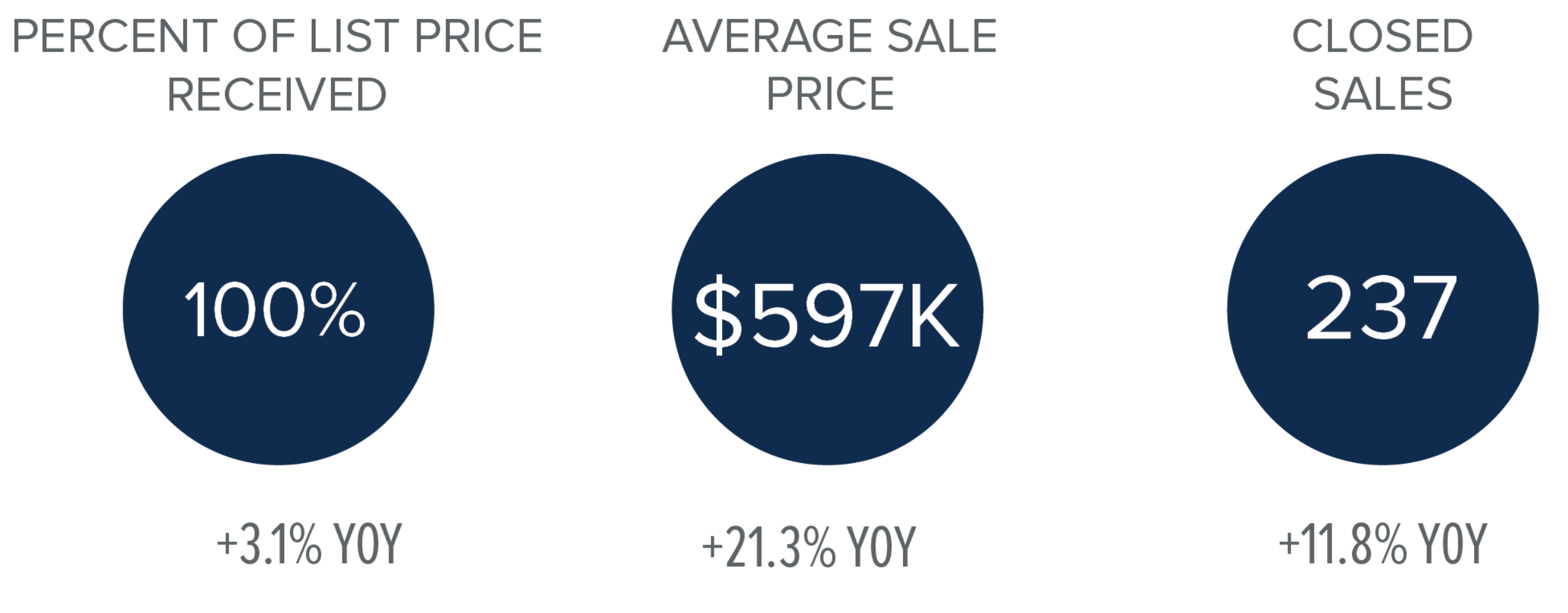

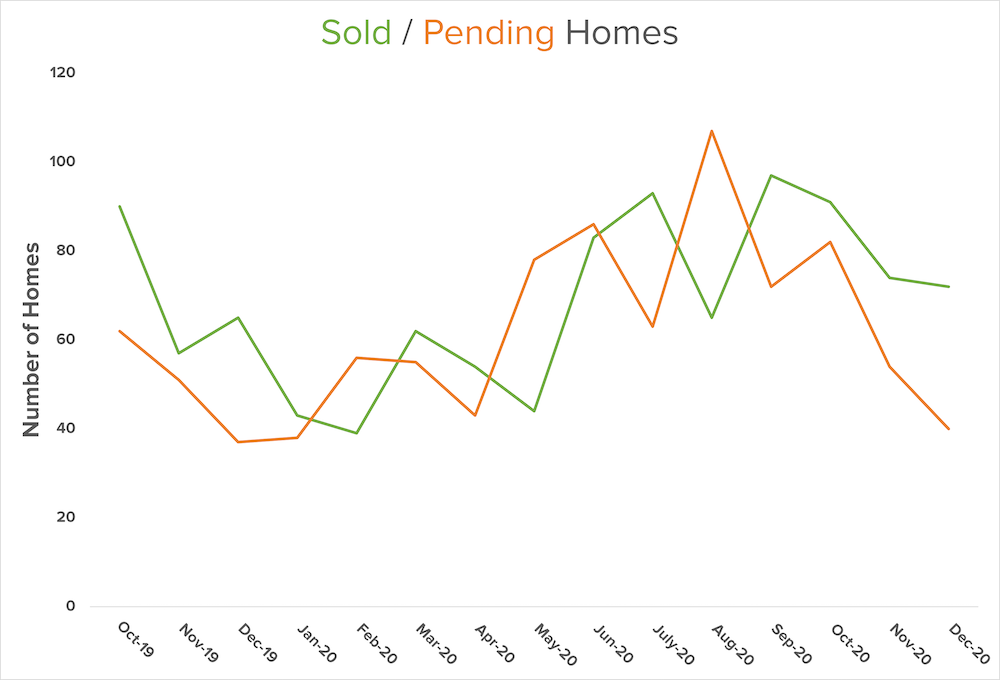

Fourth Quarter Review and 2021 Forecast for North Kitsap

Poulsbo’s North Kitsap market saw a strong end to 2020. We’ve compiled key highlights from our fourth quarter as well as some useful insights from Windermere Real Estate’s Chief Economist, Matthew Gardner. Gardner also offers his 2021 market forecast with some uplifting and interesting predictions.

Our Strong Seller’s Market

Poulsbo’s inventory remains low while demand is high from people moving away from the bigger cities. Buyers, the market is in the usual seasonal slowdown – but not as slow as expected given COVID-19. There are still many eager buyers outnumbering sellers. Our Brokers have seen an increase in situations where some buyers are outbid either by price or by an all-cash offer.

In 2020’s fourth quarter, the average sale price in North Kitsap was up 21.3% year-over-year at $597K. Sale prices continue to hover close to listing prices, indicating strong demand.

2021 Forecast

In his final Monday with Matthew video of 2020, our Chief Economist, Matthew Gardner, shared his 2021 forecast for the housing market. He’s optimistic and for some good reasons.

First off, Gardners expects mortgage rates will not rise significantly on a local level, nor will they vary significantly throughout different regions across the U.S. Since mortgage rates are heavily tied to 10-year treasury maturity rates/yields, rates shouldn’t rise significantly until the entire market recovers from the COVID-19 slowdown. Another great sign is that Gardner expects home sales will grow significantly, from 5.55% in 2020 to 5.93% in 2021. That’s “to a level we haven’t seen since 2006,” Gardner explains. With the continuation of historically low mortgage rates and the consistent increase of home values, 2021 looks bright.

“No! There isn’t a housing bubble forming. But price growth will slow & sellers may feel like it’s a collapse … it isn’t collapsing, it’s just normalizing.”

Matthew reminds us that there are pitfalls to be wary of in this strong market. First and foremost: “we need more inventory.” With the shuffling to new homes, and the huge wave of “first-time buyers [that] will continue to be a major player in the housing market,” many are making moves in a flood that will not persist. Buying during the pandemic will slowly settle. People are expected to stay in their homes longer, especially homeowners who have chosen to refinance. House values will rise due to the lack of supply, and that may price out many buyers who want to purchase in our area.

Western Washington’s Market Report

For a big picture glance at how our local market compares, here are highlights from The Western Washington Gardner Report.

WESTERN WASHINGTON HOME SALES

- Total Sales: 26.6% increase from Q4/2019, but 8.3% lower than Q3/2020

- Homes for Sale: 37.3% lower than Q4/2019, and 31.2% lower than Q3/2020

- Pending Sales: up 25% from Q4/2019, but 31% lower than Q3/2020

- Average: $617,475 (up 17.4% from Q4/2019). This continues the trend of above-average appreciation of home values.

- Interestingly, prices between Q3 and Q4 of 2020 only rose by 1%. Is there a price ceiling we’re reaching?

- Mortgage rates will stay competitive as the market continues to charge toward a price ceiling and potential affordability issues.

- Average: 31 Days (16 days less than Q4 just one year ago)

- In Kitsap County, average days on market: 17

Conclusion

2021 will continue the trend of working from home, which keeps demand high. This, in turn, will drive sales growth, while affordability barriers will balance our current runaway appreciation for home values.

New Agent Spotlight: Angela Winks

We are proud to feature Angela Winks in our new Q&A spotlight series. With a diverse set of skills and experiences, Angela offers buyers and sellers a focused, personalized approach with an emphasis on clear communication, positivity, and a sincere appreciation for the areas and clients she serves. Read on to find out about Angela’s background, what she loves about real estate, and more.

What drew you to real estate?

What drew me to real estate was my passion for all things “home” and my deep desire to help others. I also have always had the desire to have and manage my own business. As a business owner, personal growth and a positive mindset are a vital part of every day and I absolutely love being in an industry that constantly requires me to learn and be more so that I can give more to my family, friends, clients, and community.

What unique professional experiences or skills do you possess that enhance your abilities as a Realtor?

My years of experience in the health and fitness field helped me sharpen my skills as a strong communicator and leader. As an ACSM Certified Personal Trainer and Director of a post-physical therapy exercise program, I had the opportunity to help clients and patients set and achieve their goals, not only safely and effectively, but in a welcoming and fun environment.

As a Realtor, I enjoy the same opportunities. Whether my clients need to sell or buy real estate, it’s important to have clear communication and a great plan. And, of course, it is always my pleasure to make the whole process as enjoyable as possible for my clients!

What personality traits do you think are important in this profession?

Realtors should possess exceptional interpersonal communication and relationship skills as well as the ability to stay open-minded, focused, organized, and creative.

Which areas do you serve and what do you love about those areas?

I happily serve Kitsap, Pierce, Mason, Jefferson, and King counties. I believe we are incredibly fortunate to live in this part of the country and Washington state. The natural beauty is astounding and the support for the communities and their wonderfully unique local businesses is second to none.

How long have you lived here?

I have lived in Kitsap County for 7 1/2 years. I came here after college because I had family scattered around the area and fell in love with the natural beauty.

What made you decide to work with Windermere?

I decided to work with Windermere because of their special focus on building and nurturing relationships as well as their strong presence in the community. This is a company that truly cares about people and that is extremely important to me! They also provide the latest technology and education for their agents so we can always keep adding tools to our real estate toolbelts and serving our clients at our highest level.

We are delighted that Angela Winks has joined us. We know she will be a sincere pleasure for buyers and sellers to work with here on the Kitsap Peninsula and in Pierce, Mason, Jefferson, and King County. You can connect with Angela through her website.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link