Poulsbo’s North Kitsap market picked up in our first quarter despite a seasonal slowdown. We’ve compiled key highlights so that you can easily get informed about our local real estate market.

Our Strong Seller’s Market

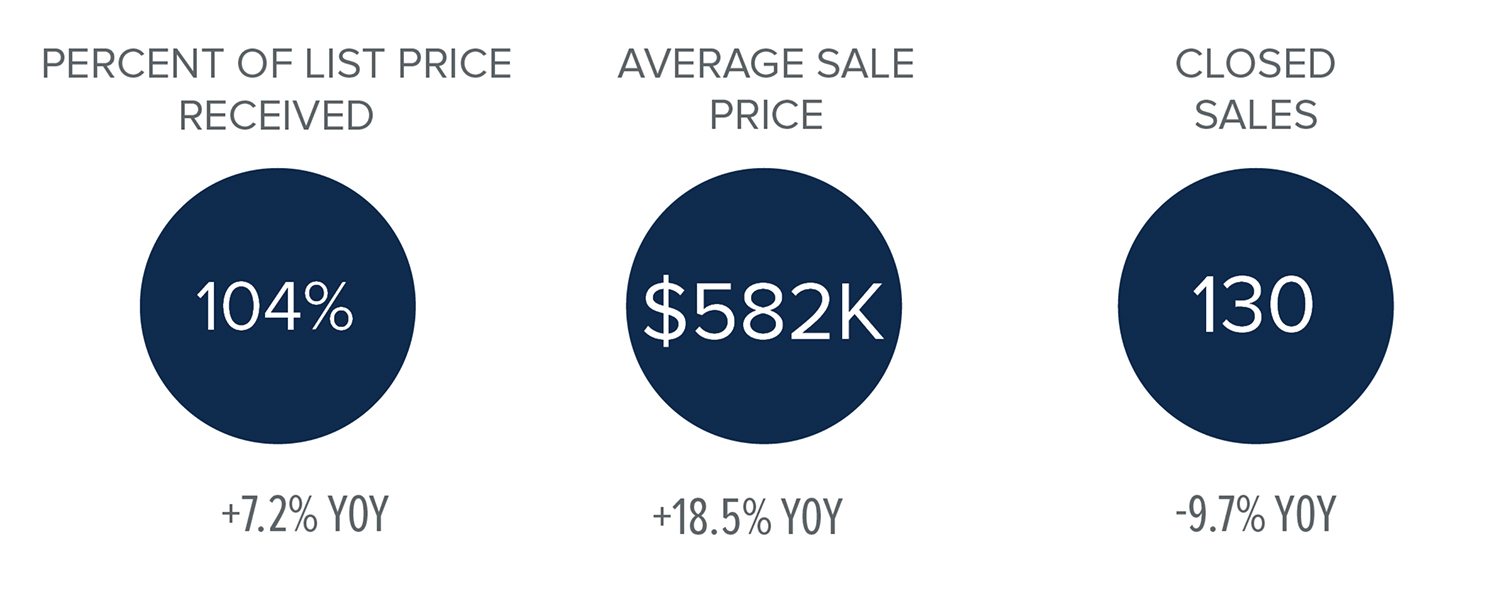

North Kitsap’s inventory remains low and demand remains high due to people moving away from the bigger cities and COVID-19 changing the way we work. There are still many eager buyers outnumbering sellers. Our Brokers continue to experience situations where some buyers are outbid either by price or by an all-cash offer in this competitive market.

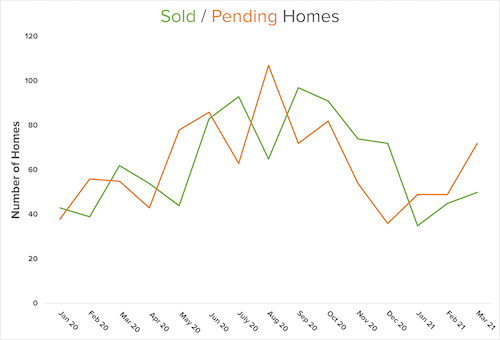

If you look at the last five quarters detailed in the graph below, you can see that a similar growth trend in volume is repeated when comparing 2020’s first quarter to 2021’s first quarter. Get ready for the market to continue to heat up as we move from spring to summer.

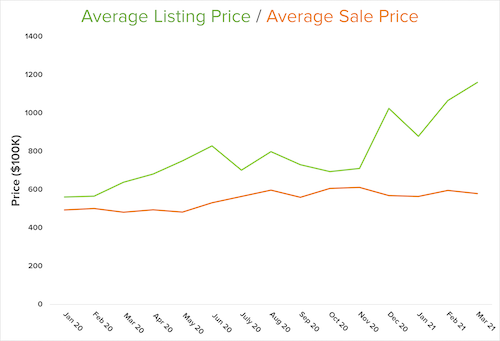

With our low supply, we may see even higher prices. This strong seller’s market is driving us toward an affordability ceiling. As you can see below, there’s a growing listing and sale price divergence. Sellers continue to benefit from our inventory shortage. Prices may soon be too high for some people to afford to buy a home here.

Affordability Issues and Market Insights

Matthew Gardner, Windermere’s Chief Economist, continues to track this affordability ceiling in his most recent Housing and Economic Update: “If the pace of home price growth continues, many households will start to be priced out” of what people can actually afford. As Gardner points out, we need more supply, and we need home prices to drop to alleviate this market strain.

Unfortunately, that might not happen fast enough for many hopeful homebuyers to make their dream a reality. Gardner reminds us that the cost of materials, recent storms, and the current housing market prices have all added to the cost of building new homes. This, in turn, will add to the listing price.

Additionally, Gardner points out that mortgage rates have risen after “a jump in bond yields has led rates to spike” as the country re-opens and economic activity increases. The resulting potential inflation causes the 10-year treasury interest rates to rise in hopes of attracting more buyers. However, it is still far below standard rates and shouldn’t be a concern for buyers right now.

Ultimately, it’s still a strong Seller’s Market with an overall low supply and high demand. We expect to continue to see issues with affordability as prices continue to climb.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link