Our North Kitsap real estate market has been even more competitive for buyers. Read on for key highlights from our strong third quarter and insights from Windermere’s Chief Economist, Matthew Gardner.

Our Competitive Market

North Kitsap’s inventory is now lower than last year while the demand remains high. Remote working culture seems here to stay, opening doors to the greener pastures of Kitsap living. These eager buyers outnumber sellers, which is reflected in the lower volume of closed sales when compared to this same time last year. Our Brokers continue to experience situations where some buyers are outbid either by price or by an all-cash offer. But if you’re looking to buy, don’t let that discourage you. From first-time buyers to seasoned investors, our local experts are here to guide you through this competitive market.

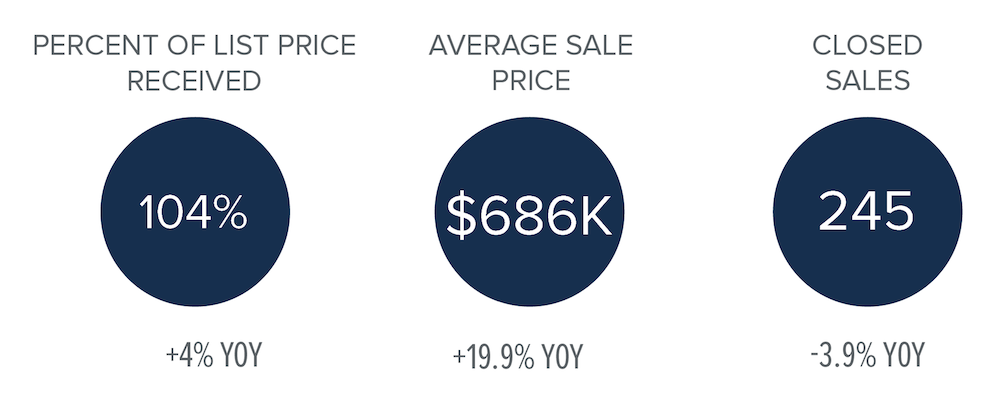

Market Data

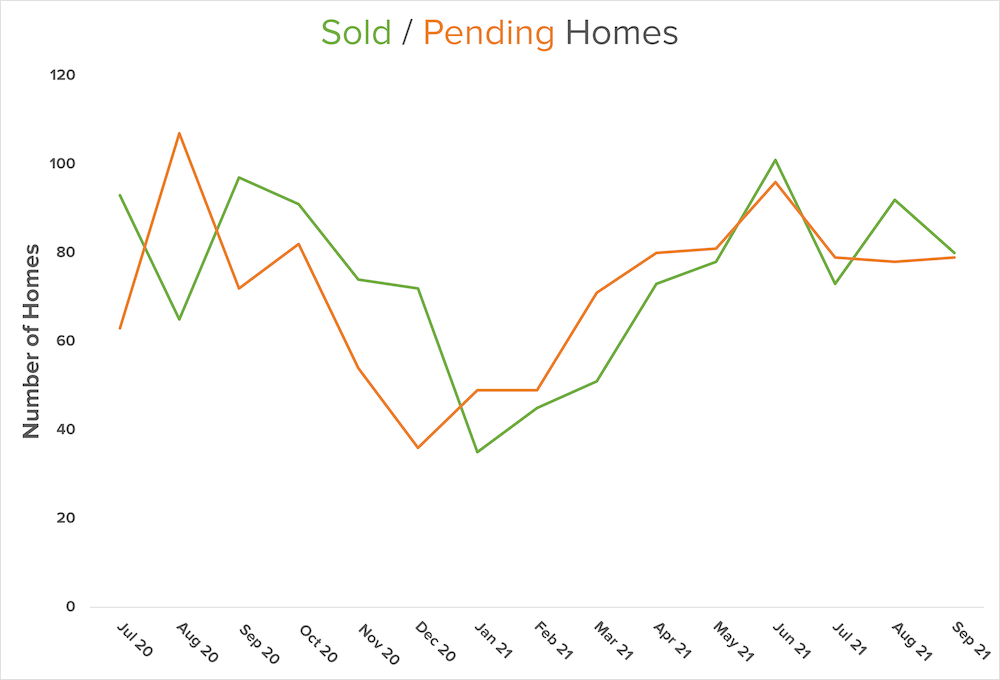

Looking at the last five quarters in the graph below, there is a noticeable plateau for this year’s third quarter when compared to 2020’s third quarter. But home prices are still increasing, and the amount of sold homes still outpace pending listings as a result of the increased demand. As we enter the slower season and inventory wanes further, prices may level, which will start to balance out the market. Or, it will at least start a shift in that direction.

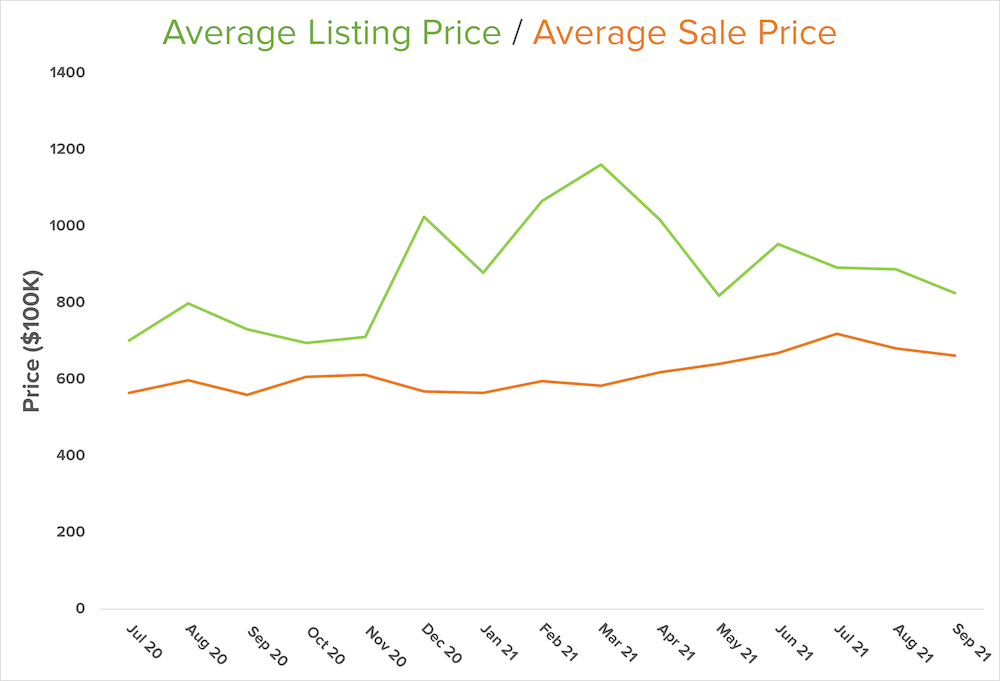

Sale prices in North Kitsap remain strong. And, as you can see below, the listing and sale price divergence went through a slight correction in the second quarter of 2021, but it’s now back on track. Our agents are still sharing experiences with many eager buyers and many happy sellers due to the continuing demand and our strong seller’s market.

Home Purchase Sentiment Index: Insights from Matthew Gardner

In his most recent Monday with Matthew video, our Chief Economist delivered a comprehensive analysis of the most recent Home Purchase Sentiment Index figures put out by Fannie Mae. The data comes from a survey containing approximately 100 questions on housing-related topics. Fannie Mae collected 1,000 consumer responses from across the country. As Matthew Gardner says, “It’s the only national, monthly survey that’s focused primarily on housing.”

The survey shows that many Americans continue to think it is not a good time to buy because of the low supply and rapidly rising prices. However, many feel it is a good time to sell as consumers predict home prices and mortgage rates will go down. As Gardner explains, “most consumers continue to report that it’s a good time to sell a home, but a bad time to buy. They most frequently cite high home prices and a lack of supply as their primary rationale…However, the good time to buy component did tick up for the first time since March.” While this is a recipe to shift towards a buyer’s market, we’ll see how things unfold in the coming months.

Gardner sums it up nicely: “The takeaways for me so far are that consumers tempered both their recent pessimism about home buying conditions and their upward expectations of home price growth.” So again, we are seeing the potential for a shift toward a more balanced market.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link