Understanding Contingencies When Selling Your Home

If you’re preparing to sell your home in Kitsap County or in the surrounding area, there is a good chance you will find an enthusiastic buyer. However, their offer may contain contingencies. Contingencies are certain conditions that must be met before the sale of a home is finalized. They are often meant to help buyers protect their interests. As the home seller, it’s important to understand contingencies you may encounter when an offer is presented.

Are contingencies common?

Yes, contingencies are quite common. If the required conditions are not met, then the seller or buyer can exit the contract. It is common for a buyer to include contingencies in their offer.

What are common contingencies?

Let’s discuss some common contingencies. First, there is the home inspection contingency. This allows the buyer to have a home inspection within a set period of time. If an inspector finds unsatisfactory conditions or concerning areas, the buyer might negotiate the price or request repairs. The contingency could require repairs to be completed before the home sale is finalized. This is why a pre-listing inspection is so valuable for home sellers. It will ensure you won’t find any surprises that may impede the sale of your home.

An appraisal contingency could play a role in financing. This contingency requires that the house must be appraised at the sale price or higher. Depending on the agreement, this contingency may also stipulate that the sale price will be reduced to the appraised value if the appraisal is lower.

A buyer might also present a home sale contingency to you as the seller. This contingency is often included when buyers are trying to buy a new house while selling their current home at the same time. As a seller, it is important to consider this carefully. You can require a specific time frame for the other home sale to take place. If the other home is not sold in time, that will void the contract. However, you may lose out on other potential offers during that time. But if the buyer’s offer is strong, a home sale contingency can be worth it.

Finally, a title contingency is common. Before the sale is finalized, a search will be conducted to ensure there are no liens or judgments against the property. It’s a good idea to pull a pre-title report prior to listing your home to set yourself up for a smoother transaction.

How can I ensure my home is prepared?

Avoid these mistakes, and get all the necessary documents together. Gather your home’s title history and documentation regarding your property’s condition. Ask your trusted, local real estate agent to conduct a Comparative Market Analysis. Have a pre-listing inspection completed. This will give you time to make necessary home improvements, which will give you a high return on your investment. Staging can also be very beneficial.

Also, consider the Windermere Ready program. Your Windermere real estate agent can create a customized plan of action. And, Windermere can provide financial assistance so you can sell your home for more in less time. Watch the video below to learn more about this advantageous program.

Who should I consult with to review contingencies?

A knowledgeable agent can walk you through it all. They understand your needs and will advocate for them. It’s crucial to have a strong negotiator at your side, especially when discussing contingencies. Don’t be afraid to ask questions so that you can make well-informed decisions.

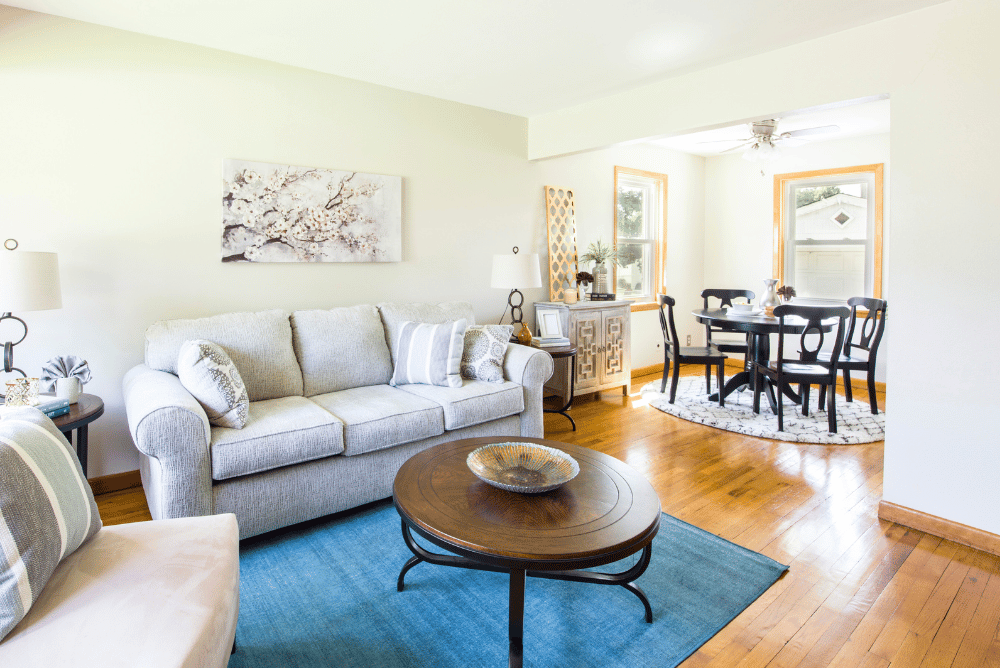

Staging a Home: Costs and Benefits

When it comes to selling your home, it’s essential to stand out to ensure the best price with the most favorable outcome. One effective way to do that is by staging your home. Staging will present your home in the best possible manner, appealing to homebuyers online and in person. Let’s explore the costs and benefits of home staging.

The Costs of Home Staging

Staging a home is an investment, and it’s important to understand the potential costs involved. The expenses can vary depending on the size of your home, the extent of the staging required, and your location. Here are some typical costs to consider:

- Professional Staging Services: According to data from HomeAdvisor, home sellers pay between $778 and $2,851 in home staging costs. However, the price can vary widely depending on how much staging needs to be done, if your home is vacant or not, and how big it is. How long your home is on the market also impacts the cost due to monthly furniture rental fees.

- Furniture Rental: If your home is vacant, you may need to rent furniture and decor to create a warm, inviting ambiance. Furniture rental costs can range from a few hundred to a few thousand dollars per month.

- Repairs and Updates: Sometimes, staging involves making necessary repairs or updates to your property. This may include fresh paint, minor updates, or landscaping improvements. Costs can vary, and a local expert will be able to assess your property’s specific needs.

- Storage Costs: If you need to store some of your belongings while your home is staged, you’ll need to consider storage costs.

- Utilities and Maintenance: While your home is on the market, you’ll need to keep your staged home in excellent condition. This may require additional utility expenses, as well as regular maintenance costs.

If you need financial assistance preparing your home, the Windermere Ready Program has benefitted many of our sellers. We can provide up to $100,000 and the program includes a personal consultation with one of our local real estate agents, high impact updates, and professional staging.

Why Sellers Should Stage Their Homes

Now that we’ve discussed the costs, let’s dive into the compelling benefits of staging your home:

- Faster Sale: Homes that are professionally staged tend to sell faster than unstaged properties. According to the National Association of Realtors (NAR), staged homes spend 73% less time on the market on average.

- Higher Selling Price: Staging can potentially increase your selling price. According to the National Association of Realtors, a 2021 report found that 85% of staged homes sold for 5% to 23% over the listing price.

- Improved First Impressions: Staging helps create a memorable first impression, making your home more attractive to potential buyers. An inviting and well-organized home can go a long way. In a 2023 study, 81% of buyers’ agents said staging a home made it easier for potential buyers to visualize the property as a future home.

- Increased Visibility: In today’s digital age, most homebuyers start their house hunt online. Staged homes typically photograph better, making your online listings more engaging. A captivating online impression can lead to increased clicks on your listing and increased foot traffic at open houses.

Why Use a Local Real Estate Agent

To ensure the successful staging of your Western Washington home, we highly recommend partnering with a knowledgeable, local real estate agent. Here’s why:

- Market Expertise: Our local agents understand the intricacies of Kitsap County’s real estate market. They know what buyers want and will tailor the staging process accordingly.

- Professional Network: Our experienced agents know excellent stagers, contractors, and other professionals who can assist.

- Pricing Strategy: Our real estate agents will help you determine the optimal pricing strategy for your staged home, ensuring you get the best return on your investment.

- Negotiation Skills: When it comes time to review offers, you want someone who will serve as your trusted advocate, using their negotiation skills to secure the best possible deal for you.

In conclusion, the benefits of staging a home far outweigh the investment. A well-staged home sells faster and at a higher price, and partnering with a highly-rated, local real estate agent ensures success. So, if you’re looking to sell your home in this beautiful corner of the Pacific Northwest, feel free to contact us with any questions you may have.

Real Estate Insights From Our Chief Economist, Matthew Gardner

Once a month, Matthew Gardner, Windermere Real Estate’s Chief Economist, provides insights on our housing market. We’ve listed some of his recent predictions, thoughts, and conclusions to give you the information you need to make well-informed real estate decisions. And, you can also watch Gardner’s full videos below to learn even more.

The Continued Decline of the Housing Market Index

The National Association of Home Builders released their Housing Market Index for August, and the data was “eye-opening” as Matthew Gardner says. Based on a survey of home builders, this index asks them to give their take on the single-family market. Builder confidence fell for the 8th straight month, dropping below the index level of 50. As Gardner explains, “More home builders currently rate sales conditions as poor than good…Builders have been reporting a spike in canceled contracts recently.” Additionally, all components of the Housing Market Index are at their lowest level since May of 2020. 69% say mortgage rates are the primary reason, and 19% of builders have reduced prices in an effort to increase sales. Gardner says he uses the Housing Market Index as a reliable indicator when it comes to single-family housing starts.

When it comes to new homes for sale, there’s a rise in listings of 32.1% year-over-year. Furthermore, of the homes currently for sale, 67% are under construction. 24% haven’t broken ground yet, and 9% are ready for new owners to occupy them. While it may seem like it isn’t that bad since only 9% are finished, Gardner points out that “builders incur costs every day that the home is not sold, even if that home has yet to be built.”

“With more homes for sale and lower transactions, it would now take more than 9 months to absorb all available homes using the current sales pace.” As a result, new home starts fell by 10.1% between June and July of this year. And, starts have dropped by 18.5% from a year ago.

Affordability is a key issue that Gardner highlights. He also points out how construction costs have impacted builders. And, that is magnified by the fact that they’re competing with rising inventory in the resale market. “Last month, the average price drop was 5% but this is very likely to increase as we move toward the fall.”

To learn more, watch the full video below.

Mortgage Rates and Inflation

In the beginning of 2022, 30-year conventional mortgage rates started at just over 3.1% but have skyrocketed to 6%. While economists like Matthew Gardner expected rates to trend higher this year, no one anticipated such a dramatic increase. That’s because no one could’ve factored in Russia’s invasion of Ukraine and that inflation would continue to climb for much longer than we expected. As a result, “when inflation is running hot, it limits demand for bonds,” Gardner explains. This then “forces the interest rate payable on those bonds to rise and this pushes mortgage rates higher.”

Gardner also looks at other inflation indicators, which point to the fact that slower spending acts as a headwind to further price increases. He also looks at the Producer Price Index, which measures at the wholesale level, not the retail level. “Even though the total rate rose as energy costs continue to impact the manufacturing sector, the core rate has been pulling back again for the past three months.”

Matthew Gardner concludes, “If the trends we’ve looked at continue, I still expect inflation to start slowly creeping lower, which will push bond prices higher, yields will start to, if not drop, then certainly pause. That will allow mortgage rates to hold at – or close to – their current levels for the time being. But we could actually see rates coming down a little.”

You can watch more of Gardner’s videos on Windermere’s YouTube channel. If you have any questions about the information we’ve shared, feel free to reach out to one of our local real estate experts. Our agents are highly knowledgeable and happy to assist you.

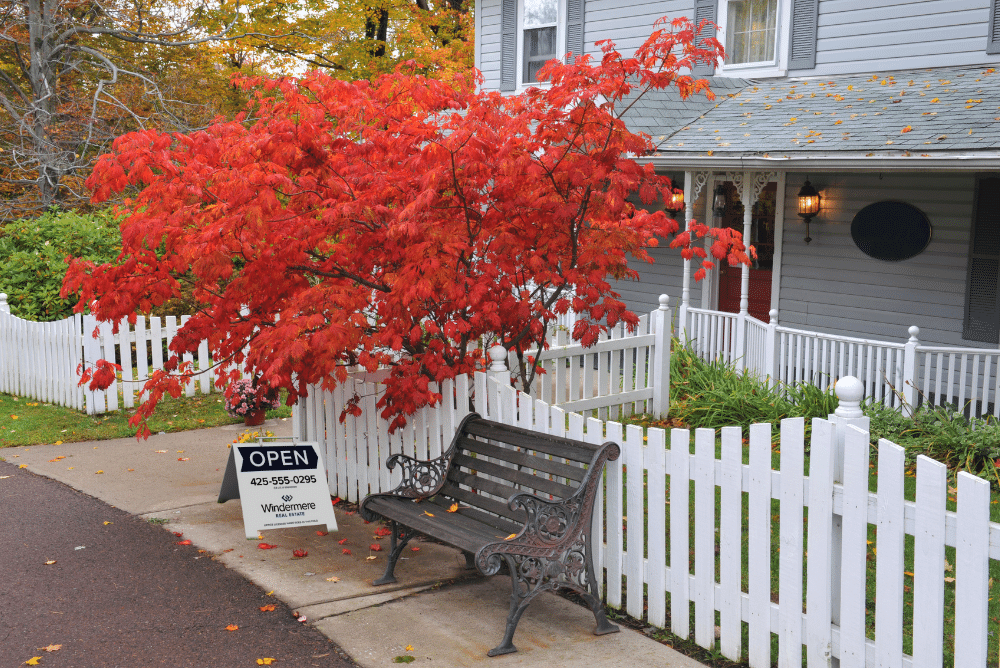

Fall Home Sales: Why Autumn is a Good Time to Sell Your Home

Are you thinking about selling your home, but worried since it isn’t spring or summer? Fall is actually a good time to sell your home and it comes with some unexpected perks. Keep reading to learn more about the benefits of fall home sales.

Fall Ambiance

Autumn is a beautiful time of year, especially here in the Pacific Northwest. The leaves are turning, the air feels crisper, and the holidays are fast approaching. All these things can strengthen your home’s curb appeal. Take advantage of autumn’s allure by keeping your yard and home’s exterior pristine. Make time to rake the leaves and keep your gutters clear. By keeping things tidy, you are giving your home’s natural fall foliage a chance to shine. You can also add a touch of autumn ambiance to your home’s indoor spaces by decorating with fall colors. Staging your home with autumn accents gives it an extra cozy feel that draws in potential buyers.

Julie Bray-Larsen, Windermere Poulsbo Managing Broker

Less Competition

Since spring and summer are real estate’s busy seasons, in the fall there are fewer homes listed for sale. Generally, this means less competition for you and fewer options for buyers. With not as many houses on the market, your home has a greater chance to dazzle potential buyers. As Windermere Poulsbo Managing Broker, Julie Bray-Larsen explains, “Fall is a great time to list your home here in Kitsap County. Our weather is still beautiful, so the landscaping is still looking nice. Most importantly, there’s typically less competition in the market. Because there are always buyers out looking, your home will stand out more as a potentially great fit for buyers wanting to purchase and move in before the holidays.”

Serious Buyers

People looking for homes in the fall are serious about buying. Generally, they have a reason to move at that time whether it’s because they are relocating for a job, downsizing, first-time buyers, or service members. “Our large military community in Kitsap means those buyers need to move all months of the year, so that added demand is great for sellers,” says Bray-Larsen. Serious buyers also want to find a place and get settled in before the busy holiday season starts. This adds another level of urgency to finding a home, which can benefit sellers.

Faster Closing

Since there are usually fewer real estate deals during the fall, everyone involved in the transaction process tends to have greater availability. “Mortgage brokers and escrow officers are less busy after the summer rush, so financing is more quickly approved. Therefore, buyers will be ready to go,” explains Bray-Larsen. This greater flexibility also applies to real estate agents, home inspectors, and appraisers. As a result, it’s easier to schedule appointments, and everything moves faster, which is great for sellers.

Now that you can see why fall is an excellent time to sell, check out the Windermere Ready Program. Windermere can assist by investing in important home upgrades or repairs to help you sell for more and in less time. Contact one of our real estate agents for more information.

Windermere Ready Program: Sell Your Home for More

To get the best offer for your home, making a great first impression is key. In fact, our belief in the importance of first impressions is so strong that we developed the Windermere Ready program to support sellers. With professional advice from local experts, our program prepares your home to wow potential buyers. Also, we’re ready to provide financial assistance if necessary.

Sell For More Faster

Typically, sellers who invest in making repairs and upgrades sell their homes faster and for more money, sometimes even above the asking price. By taking action to make sure your home makes a great first impression, you set yourself up for success. After all, you only have one chance to transform a buyer’s interest into excitement.

To help make this possible, the Windermere Ready program provides:

- A personal consultation

- Customized home plan

- High impact updates

- Professional staging

Many buyers prefer stylish, turnkey homes, but some are also looking for specific features and amenities. This makes it challenging to know which repairs and upgrades will lead to the best offer. The Windermere Ready program takes the guesswork out of preparing your home with an individualized assessment. Based on your timeline and needs, one of our Windermere Poulsbo agents will work with you to identify your home’s most important improvement priorities.

Once critical repairs and priority upgrades are identified, your Windermere agent will create a custom action plan and work schedule to keep your timeline on track. To ease implementation, they will recommend local service providers and coordinate access to your home as needed.

High Impact Improvements

Great first impressions sometimes come from simple updates and small changes. A new coat of paint and a bold, colorful door gives your home a fresh look and curb appeal. Additionally, small interior upgrades such as adding new light fixtures or cabinet hardware provide stylish, eye-catching details. These enhancements capture a buyer’s attention and help make a house feel like home.

Exterior items that we focus on:

- Painting

- Window Washing

- Landscaping

- Lighting

- Entrance Detail

- Power Washing

- Decorative Window Features

Interior items that we focus on:

- Painting

- Carpet Cleaning/Replacement

- Floor Repair/Refinishing

- Fixture Repair or Replacement

- Cosmetic Updates

- Decluttering

- Professional Deep Cleaning

Staging Your Home Provides an Important Final Touch

After making repairs and updates, we recommend one more final touch—staging your home. Professional stagers help your home make the ultimate first impression by highlighting the best features of each room. A staged home improves your chance of receiving the best offer by helping buyers visualize themselves living there. According to Forbes, staged homes sell 87% faster and for 17% more than non-staged homes.

We’re Invested in Your Success

To help prepare your home for success, we can provide up to a $100,000 loan to assist with expenses if needed. The loan term is six months and there are no upfront costs and no monthly payments due during that time. When your home is sold, the loan is paid off in one lump sum. For more information about the Windermere Ready Loan and how it works, please contact us.

Get Started

Finally, to get started, contact a Windermere Poulsbo agent for a Comparative Market Analysis to see what your home is worth. A Comparative Market Analysis is more in-depth than an online home estimate and from there, an agent can discuss what possible home repairs and upgrades could increase your home’s value. The Windermere Ready program will help prepare your home to make the best first impression and help you sell your home for more.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link