Want to Sell Your Home? Avoid These Mistakes

If you want to sell your home, it’s important to prepare in every way – and that includes avoiding pricey missteps. Selling a home involves various fees and costs. However, it also involves opportunities to maximize your profit. In order to have the best home-selling experience, avoid these costly and timely mistakes.

Not considering home-selling costs

There are many costs associated with selling a home. Prior to listing, remember to take into account the price of a pre-sale inspection and the listing agent’s fees. In addition, getting your home ready for sale may require repairs and/or staging.

After selling the home, there will be the remainder of the mortgage to pay, escrow fees, and property taxes. Additional taxes may apply to your unique situation, such as the capital gains tax. Finally, factor into your budget the cost of moving. You may need to hire movers, rent a moving truck, or find a storage unit during the interim period.

Not preparing your house for sale

While there will be fees and costs associated with moving, there are ways to guarantee your home is sold for its highest possible price. First and foremost: prepare your home for the market. Ordering a pre-listing inspection and discussing it with your real estate agent can help you decide what repairs will have the highest return on investment. As a result, the pre-listing inspection and repairs will often lead to a much smoother transaction.

Also, staging a home often results in the home being on the market for a shorter period of time. An expertly staged home instantly entices buyers, shows off the property’s best features, and helps them easily see themselves living there. Additionally, staging often leads to a home selling at a higher price point. The investment in repairs and staging can make a significant impact. A turnkey or move-in ready home drives sales. Sure, preparing to sell your home is an investment of time and resources, but it is a powerful revenue-generating task.

Not using a local real estate agent

A knowledgeable, local real estate agent can have a profoundly positive affect on the home-selling process. According to the National Association of Realtors, a good local Realtor will understand the specifics of the market you are selling in, have access to greater search power and offer objective opinions to maximize your home’s value. While some may try the “for sale by owner” approach, working with a local real estate agent offers many benefits. Utilize their expertise to maximize your efforts. A trusted advocate will have your back when it comes to negotiations, they’ll project manage for you, and you’ll have access to their network of excellent local vendors to get the job done right.

Not getting a CMA

One value a real estate agent can provide is a free CMA. A CMA is a Comparative Market Analysis. It is a comprehensive report that compares your property to others in the area. After walking through the home to get a general idea of its condition, the real estate agent will look at similar homes that have sold in your area. The agent will also consider local market trends and seasonal factors, as well as the location of the home.

The value of the report lies in its ability to ensure a home is priced to sell. In addition, the report can give insight into what upgrades and repairs are the most cost-effective to maximize a home sale.

Not taking advantage of home-selling programs

A distinct advantage of working with Windermere is its amazing program for home sellers. The Windermere Ready program is designed to help sellers make an excellent first impression with potential buyers. It provides the home seller with a personalized assessment and consultation with a Realtor to identify custom priorities for updating and repairing the home.

This personalized assessment takes the guesswork out of selling a home and allows the owner to maximize their profits with strategic updates and planning. Many Windermere agents and their clients have found great success with this program, as demonstrated in the video below.

Not waiting to sell

Generally speaking, it is better to hold onto a home for as long as you can. However, unexpected moves, family priorities, and job opportunities are some of the many common reasons a homeowner may decide to sell. Many may wonder: is two years enough time to wait before selling a home?

This is when it is important to consider the selling fees mentioned above. Closing costs, agent commissions, and taxes may not make selling the home a profitable financial decision. It’s also important to keep in mind that a home sold before two years have passed is subject to capital gains tax. Ensure you look at all the numbers before selling your home to ensure it has appreciated enough to cover closing costs.

The general rule of thumb is that it typically takes five years for it to make financial sense to sell a home.

Not accepting the best offer

Sometimes the best offer does not come from the highest bid. It’s important to discuss all the terms of the offer with your real estate agent. Cash offers or buyers who are pre-approved by a lender may be likely to close the deal on time.

In addition, go over all the contingencies laid out in the offer. Take into consideration the offer’s proposed deadlines and timelines. Look at all components of the offer to ensure it best meets your home-selling needs.

Selling a home can be a worthwhile endeavor financially. By avoiding these costly mistakes, you will be on the right track toward maximizing your home sale profitability.

Fall Home Sales: Why Autumn is a Good Time to Sell Your Home

Are you thinking about selling your home, but worried since it isn’t spring or summer? Fall is actually a good time to sell your home and it comes with some unexpected perks. Keep reading to learn more about the benefits of fall home sales.

Fall Ambiance

Autumn is a beautiful time of year, especially here in the Pacific Northwest. The leaves are turning, the air feels crisper, and the holidays are fast approaching. All these things can strengthen your home’s curb appeal. Take advantage of autumn’s allure by keeping your yard and home’s exterior pristine. Make time to rake the leaves and keep your gutters clear. By keeping things tidy, you are giving your home’s natural fall foliage a chance to shine. You can also add a touch of autumn ambiance to your home’s indoor spaces by decorating with fall colors. Staging your home with autumn accents gives it an extra cozy feel that draws in potential buyers.

Julie Bray-Larsen, Windermere Poulsbo Managing Broker

Less Competition

Since spring and summer are real estate’s busy seasons, in the fall there are fewer homes listed for sale. Generally, this means less competition for you and fewer options for buyers. With not as many houses on the market, your home has a greater chance to dazzle potential buyers. As Windermere Poulsbo Managing Broker, Julie Bray-Larsen explains, “Fall is a great time to list your home here in Kitsap County. Our weather is still beautiful, so the landscaping is still looking nice. Most importantly, there’s typically less competition in the market. Because there are always buyers out looking, your home will stand out more as a potentially great fit for buyers wanting to purchase and move in before the holidays.”

Serious Buyers

People looking for homes in the fall are serious about buying. Generally, they have a reason to move at that time whether it’s because they are relocating for a job, downsizing, first-time buyers, or service members. “Our large military community in Kitsap means those buyers need to move all months of the year, so that added demand is great for sellers,” says Bray-Larsen. Serious buyers also want to find a place and get settled in before the busy holiday season starts. This adds another level of urgency to finding a home, which can benefit sellers.

Faster Closing

Since there are usually fewer real estate deals during the fall, everyone involved in the transaction process tends to have greater availability. “Mortgage brokers and escrow officers are less busy after the summer rush, so financing is more quickly approved. Therefore, buyers will be ready to go,” explains Bray-Larsen. This greater flexibility also applies to real estate agents, home inspectors, and appraisers. As a result, it’s easier to schedule appointments, and everything moves faster, which is great for sellers.

Now that you can see why fall is an excellent time to sell, check out the Windermere Ready Program. Windermere can assist by investing in important home upgrades or repairs to help you sell for more and in less time. Contact one of our real estate agents for more information.

Kitsap’s Market: First Quarter, 2022

Kitsap County’s real estate market is picking up and had a solid first quarter. In 2021, we saw high demand and low inventory, and that is still the case. It’s still a seller’s market; homes continue to sell above the asking price. Read on for key highlights and market trends below. And, if you’re looking for the connected life that Kitsap offers, our local experts are here to help.

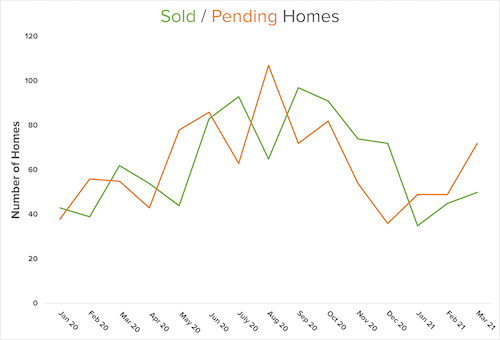

News on Sold and Pending Homes

2022’s first quarter is rising like the first quarter of 2021. You can see it reflected in the market volume graph outlined above. This follows the usual real estate market trend of a cooler first quarter and then a shift as the market heats up in warmer months. As usual in a seller’s market, sold homes still outpace pending listings and home prices are still increasing due to demand. From January through March, 994 homes were sold. That is a 10.7% increase when compared to 2021’s first quarter, showing more movement as the pandemic wanes.

Kitsap’s Market Still Favors Sellers

As supply remains low in relation to pre-Covid times, sellers can list with confidence. Buyers will need to be prepared for a competitive real estate journey. We expect more homes to come on the market as we hopefully put Covid-19 behind us.

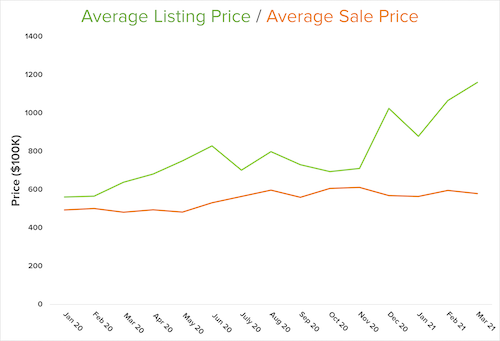

Listing Price vs. Sale Price

Kitsap’s market is still seeing many eager buyers and often competitive, multiple-offer situations. We saw a 10.8% increase in home prices year-over-year. They are expected to continue to rise as Kitsap’s market has many buyers who will continue to meet the pricing demands of sellers. However, we are continuing to see increasing affordability issues for others. The average sale price in Kitsap County is currently $606,000.

Insights from Our Chief Economist

Matthew Gardner, Windermere’s Chief Economist, shared his Top 10 Predictions for 2022 in one of his recent Monday with Matthew videos. Here’s what Gardner predicts for 2022:

- Prices will continue to rise, though the pace of appreciation will slow. Gardner thinks it will be about 6% in 2022 versus the massive 16% rise of 2021.

- Spring will be busier than expected. This will increase buyer demand, as buyers get more clarity in their new hybrid model combining remote and office work.

- The rise of the suburbs will also result from this work hybrid model. Many buyers are moving within the same area they already lived in.

- New construction jumps since the cost to build has come down.

- Zoning issues will be addressed.

- Climate change will impact where buyers live. People will focus more on how safe a location is in relation to natural disasters.

- Urban markets will bounce back after the demand drop from Covid.

- A resurgence in foreign investors will return since the travel bans were lifted last November. The demand will rise as long as our borders remain open.

- First-time buyers will be an even bigger factor in 2022. This year, 4.8 million millennials will turn 30, the median age of first-time buyers in the U.S. First-time buyers will be looking for cheaper markets.

- Forbearance will come to an end and that will be okay. It was well thought out, and as Gardner says, “as of recording this video, there are now fewer than 900,000 owners still in the program.” Hopefully, this continues to drop.

Additional Information

You can learn more from Matthew Gardner by reading his Market Update by region or watching his Monday with Matthew video series.

If you’re new to our area, check out our free Guide to Kitsap. If you’re interested in buying or selling, our local experts are here to help.

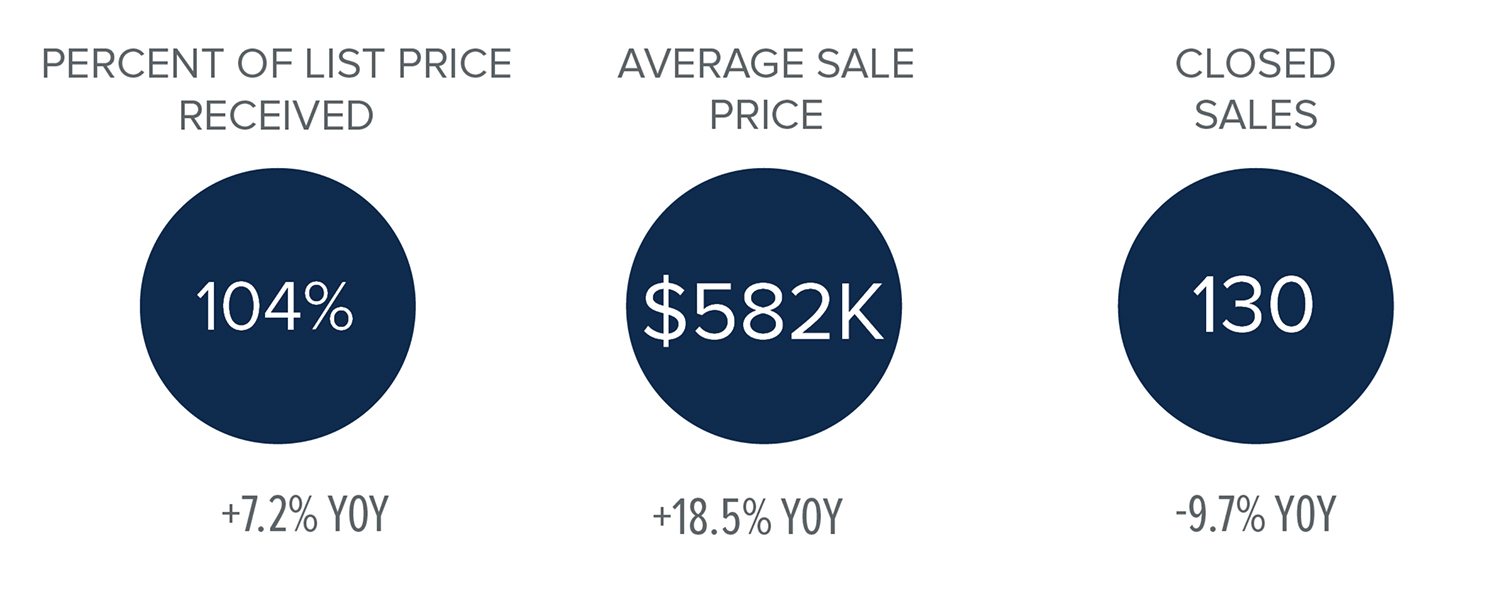

Fourth Quarter Market Review for Kitsap County

Wondering how Kitsap County’s real estate market did during 2021’s fourth quarter? We’ve compiled key highlights and insights to keep you up to date.

Just as in previous years, our local market slowed down during the holiday season. There are still many eager buyers looking to make Kitsap County their home, but fewer homes were for sale during the fourth quarter of last year. With continued low inventory, our market still favors sellers.

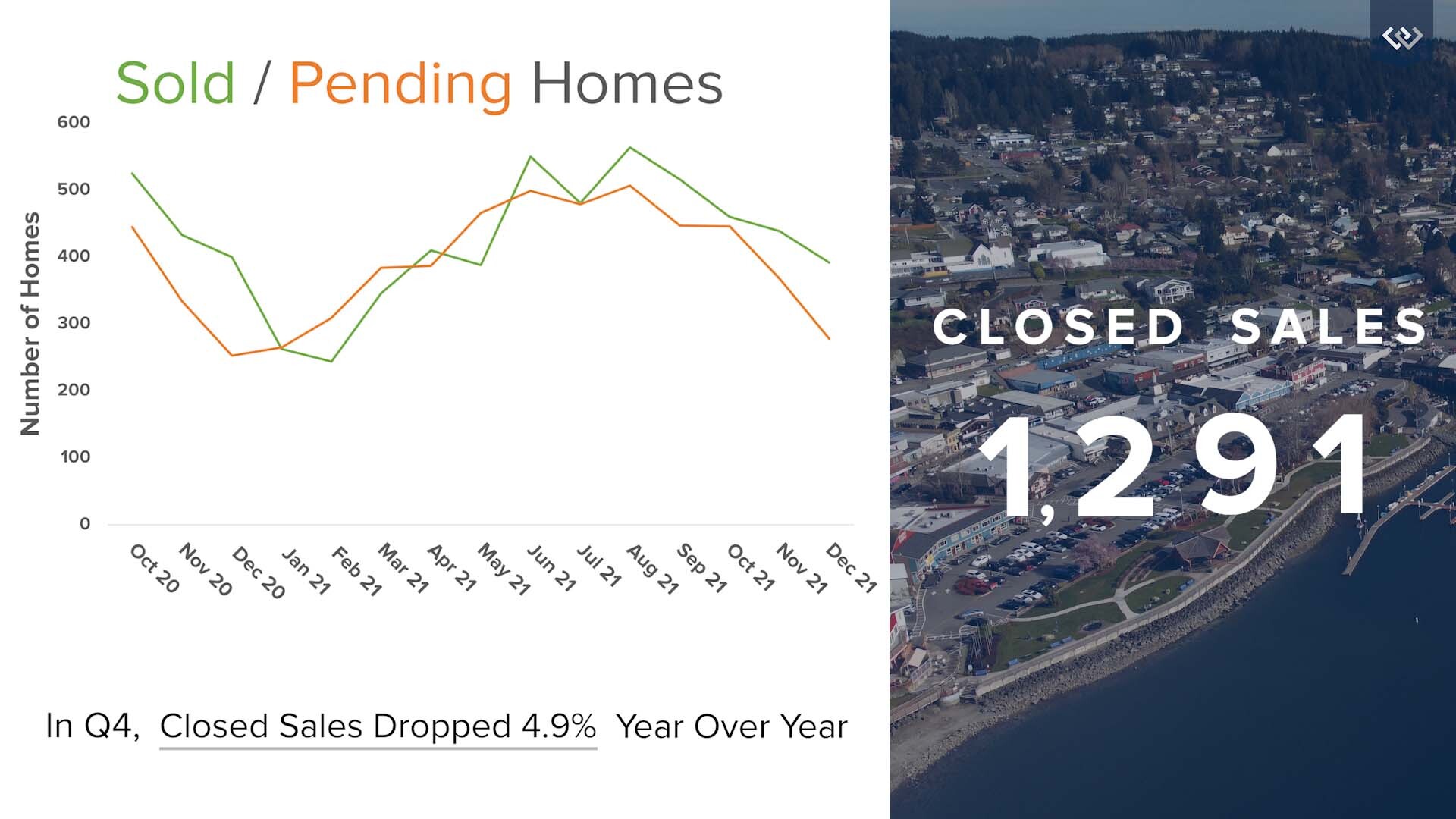

News on Sold and Pending Homes

In the last five quarters outlined in the graph above, 2021’s real estate market started with the usual growth trend into the summer. Now, we’re seeing the seasonal downswing during colder months. However, home prices are still increasing due to persistent demand, and sold homes are still outpacing pending listings. The result is a strong seller’s market. In the 4th quarter of 2021, we had 1,291 closed sales, which is a 4.9% decrease, year over year.

Still a Strong Seller’s Market

Kitsap County’s real estate demand was very high during the fourth quarter of 2021. With the new era of remote work, many Seattle homebuyers are seeking the peaceful, connected lifestyle that Kitsap offers. If you want to learn more about our area, check out our free digital guide. If you’re interested in buying or selling, our local experts are here to help.

Kitsap County’s real estate demand was very high during the fourth quarter of 2021. With the new era of remote work, many Seattle homebuyers are seeking the peaceful, connected lifestyle that Kitsap offers. If you want to learn more about our area, check out our free digital guide. If you’re interested in buying or selling, our local experts are here to help.

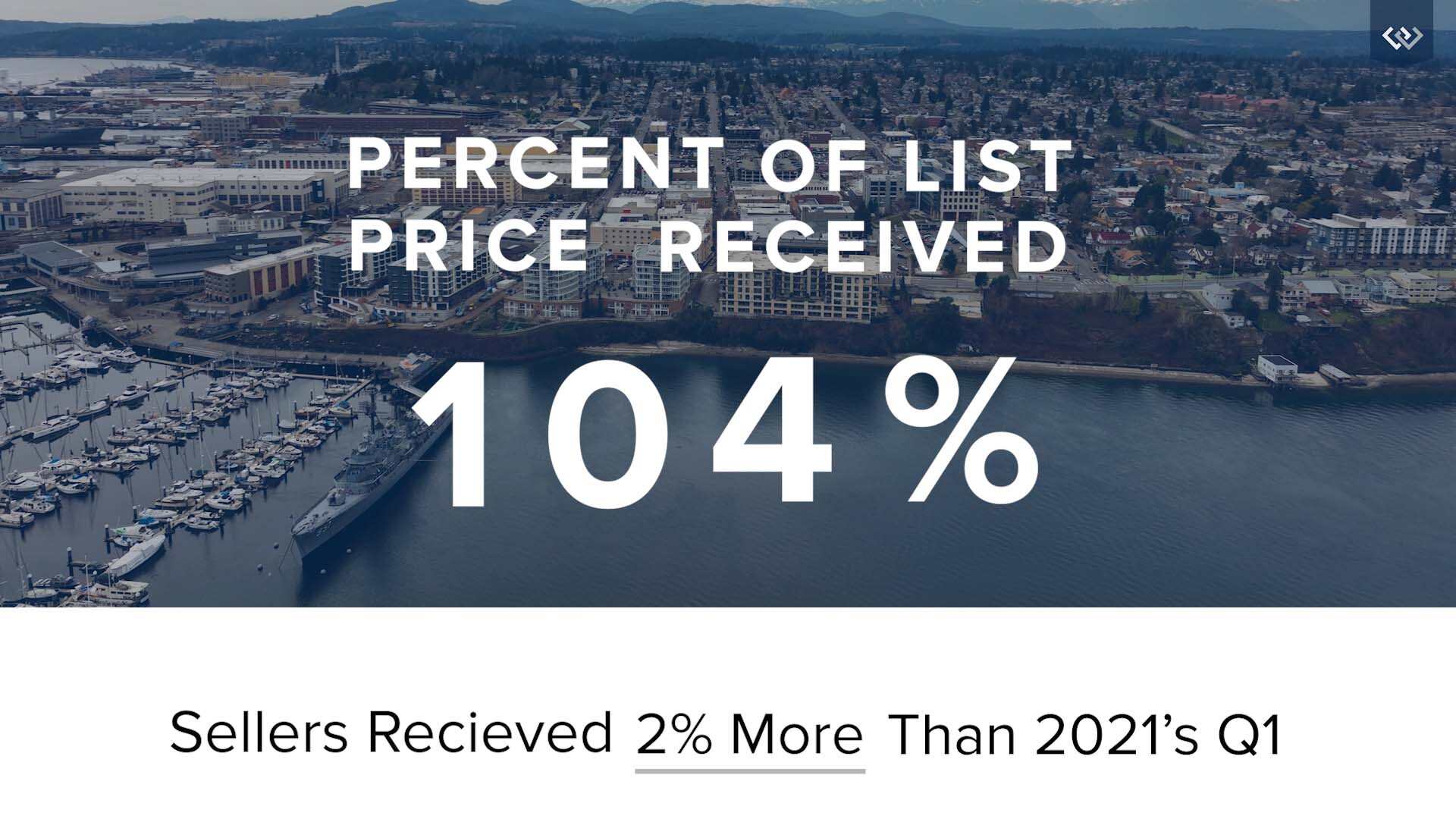

Listing Price vs. Sale Price

Although buyers continue to meet the pricing demands of sellers, there just aren’t enough homes available right now. As you can see in the graph above, the averages of listing and sale prices are starting to converge as demand pushes the cost of housing even further in favor of sellers. In our 4th quarter, we saw an 11.3% increase year over year in the average sale price in Kitsap County, putting it at $613,000. Affordability concerns have continued to be an important topic of discussion.

Insights from Our Chief Economist

Zooming out to look at the broader real estate market in our region, we have insights from Windermere’s Chief Economist, Matthew Gardner. In his most recent Monday with Matthew, Gardner shared his market forecast for the coming year: “If everything goes according to my plan, you should expect to see the housing market start to move towards some sort of balance next year, but I am afraid that it will still remain out of equilibrium until at least 2023.” This is an important reminder that the transition back to a balanced market will be a gradual shift.

While Gardner ensures us that he “doesn’t see a housing bubble forming,” he is concerned about housing affordability. There is definite cause for concern among the millennial generation as they start to settle down more and more. Millennials are currently the largest group in the generational real estate market, so it will be interesting to see where affordability and demand intersect.

Gardner concluded by saying, “demand for ownership housing remains remarkably buoyant and, in fact, it is quite likely that demand may actually increase with the work from home paradigm that will start to gain momentum next year.” In light of this dependable demand, real estate continues to be an excellent investment.

Why You May Need a Comparative Market Analysis

If you’re thinking of selling or wondering what your home is worth, a real estate agent can provide you with a Comparative Market Analysis (CMA). Not sure if you really need one? Read on to find out more.

Comparative Market Analysis

A CMA is an informative report with data that compares your property to similar properties in your local real estate market. In order to provide you with a Comparative Market Analysis, an agent will need to inspect your property. This doesn’t mean you need to hire professional cleaners as if you’re about to host an open house. You simply need to make sure your home is in good condition so that they can properly assess its condition and worth. It’s also a great time to let your agent know if you’re planning to make any changes before selling. If you don’t have an agent, our agents can provide a free analysis.

After an agent assesses your home, they will do some research to obtain data on similar properties in your area and examine regional market trends. While you can find this data through the Multiple Listing Service, a qualified, local agent will know much more, providing their local market expertise. For example, they may be familiar with the nuances of your area, recent transactions that went well or fell through there, and why. As a result, you will get a much more accurate picture than an online search would provide.

Your agent will be able to tell you how much your property is worth given the current market. Their analysis will account for all of the factors that go into pricing a home such as market conditions, location, and seasonality. They’ll discuss comparable homes or “comps” – properties with similar characteristics such as the same property size, condition, and square footage.

CMA vs. Appraisal

It’s important to note that a CMA is not an appraisal. An appraisal must be done by a licensed appraiser and is required by mortgage lenders. A bank appraiser does not have a vested interest in the sale of the home. They are there to determine your home’s fair market value. Their focus is on ensuring the bank isn’t lending the buyer more money than needed.

How a CMA Could Benefit You

If you really want to know what your home could potentially sell for right now, we highly recommend a Comparative Market Analysis. A CMA can help manage expectations and help you make informed decisions. A CMA can ensure accurate home pricing, keeping it competitive in the current market. You’ll know what homes in your area are selling for, how long they were on the market and the difference between their listing price and their sold price. You’ll be able to examine a low, medium, and high selling price for your property. Also, if you are upgrading or remodeling your home, a CMA could help you see if the changes you’re planning to make will really improve your property, setting it apart from others in your neighborhood.

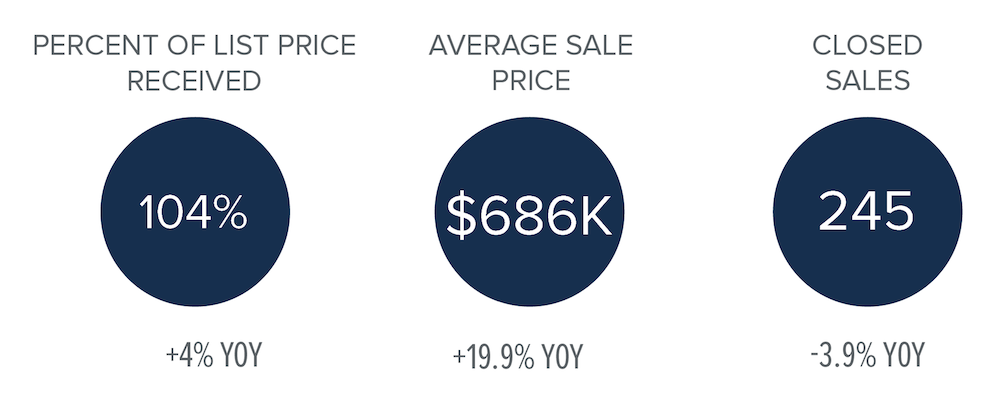

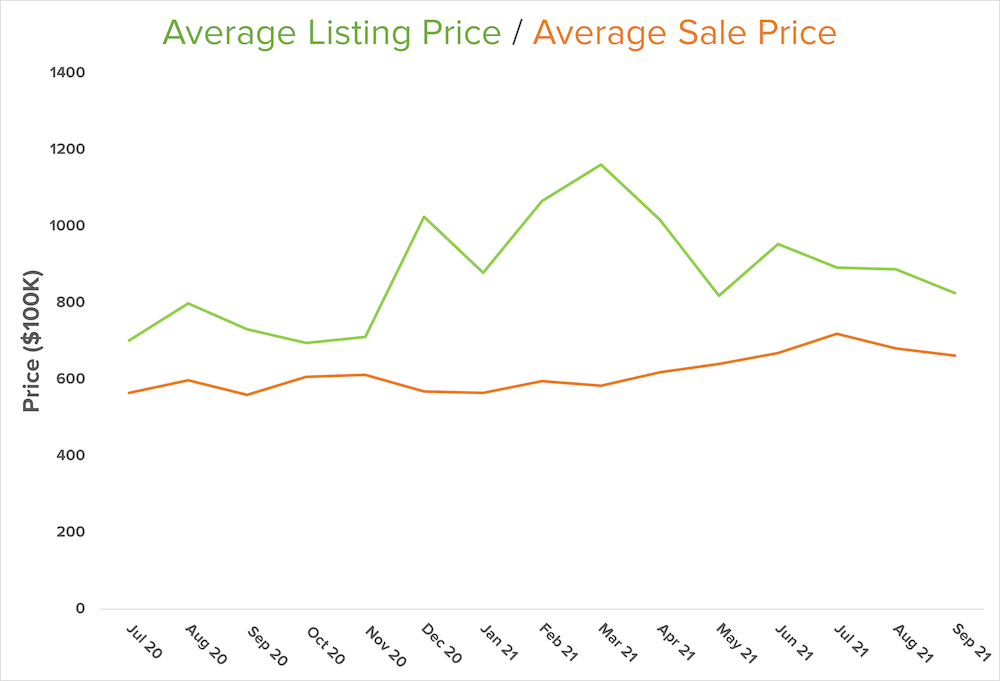

Third Quarter Market Review for North Kitsap

Our North Kitsap real estate market has been even more competitive for buyers. Read on for key highlights from our strong third quarter and insights from Windermere’s Chief Economist, Matthew Gardner.

Our Competitive Market

North Kitsap’s inventory is now lower than last year while the demand remains high. Remote working culture seems here to stay, opening doors to the greener pastures of Kitsap living. These eager buyers outnumber sellers, which is reflected in the lower volume of closed sales when compared to this same time last year. Our Brokers continue to experience situations where some buyers are outbid either by price or by an all-cash offer. But if you’re looking to buy, don’t let that discourage you. From first-time buyers to seasoned investors, our local experts are here to guide you through this competitive market.

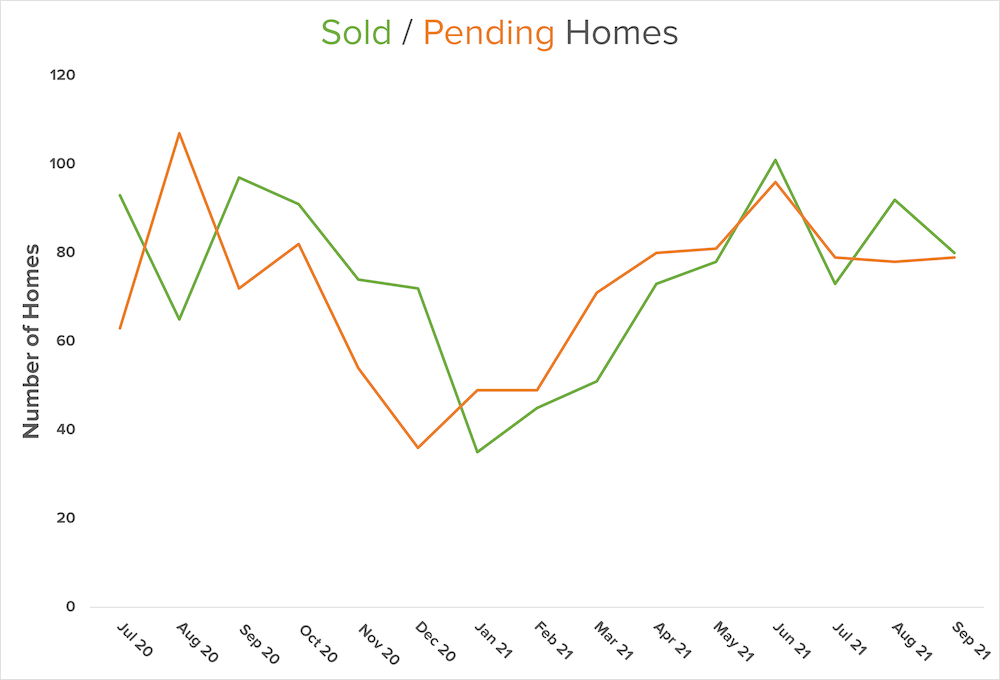

Market Data

Looking at the last five quarters in the graph below, there is a noticeable plateau for this year’s third quarter when compared to 2020’s third quarter. But home prices are still increasing, and the amount of sold homes still outpace pending listings as a result of the increased demand. As we enter the slower season and inventory wanes further, prices may level, which will start to balance out the market. Or, it will at least start a shift in that direction.

Sale prices in North Kitsap remain strong. And, as you can see below, the listing and sale price divergence went through a slight correction in the second quarter of 2021, but it’s now back on track. Our agents are still sharing experiences with many eager buyers and many happy sellers due to the continuing demand and our strong seller’s market.

Home Purchase Sentiment Index: Insights from Matthew Gardner

In his most recent Monday with Matthew video, our Chief Economist delivered a comprehensive analysis of the most recent Home Purchase Sentiment Index figures put out by Fannie Mae. The data comes from a survey containing approximately 100 questions on housing-related topics. Fannie Mae collected 1,000 consumer responses from across the country. As Matthew Gardner says, “It’s the only national, monthly survey that’s focused primarily on housing.”

The survey shows that many Americans continue to think it is not a good time to buy because of the low supply and rapidly rising prices. However, many feel it is a good time to sell as consumers predict home prices and mortgage rates will go down. As Gardner explains, “most consumers continue to report that it’s a good time to sell a home, but a bad time to buy. They most frequently cite high home prices and a lack of supply as their primary rationale…However, the good time to buy component did tick up for the first time since March.” While this is a recipe to shift towards a buyer’s market, we’ll see how things unfold in the coming months.

Gardner sums it up nicely: “The takeaways for me so far are that consumers tempered both their recent pessimism about home buying conditions and their upward expectations of home price growth.” So again, we are seeing the potential for a shift toward a more balanced market.

Our Home Inspection Checklist

Knowing what to look for in a home inspection is essential. In short, home inspections are when you hire a professional to inspect a property for any potential issues. If you’re a first-time buyer, you probably have questions about this process and we’re here to guide you.

Why Do a Home Inspection?

As a buyer, it’s typical to submit an offer contingent on a home inspection. Being cautious during the buying process is a plus. The last thing you want is to find major issues with your home after you’ve purchased it. A professional home inspector will be able to catch things that you may not have thought about or examined.

A Typical Home Inspection

A standard home inspection for a single-family home will usually take 2-4 hours. However, the length of time is heavily dependent on the size of the home. After the inspector finishes, they will send the client a report. Usually, the report will come with their findings, pictures, analysis, and recommendations.

Although the cost of home inspections can vary greatly by city and state, in Washington, the typical cost of a home inspection is around $400 – $600 for single-family homes. According to the American Society of Home Inspectors, a standard home inspection will cover:

- Heating and cooling systems

- Plumbing system

- Electrical

- Roof, attic, and visible insulation

- Walls, ceilings, floors, windows, and doors

- Foundation, basement, and other structural components

- Possible cracks in cement, indications of wood rot or water leakage

Hiring a professional, reliable home inspector is imperative. You can collect referrals from family and friends, and your local real estate agent should also have some names of inspectors they know and trust. Once you’ve found someone, you’ll be able to discuss the areas listed above after they’ve concluded their inspection.

Tips for Home Inspection Day

Here are some tips to ensure success when the home you hope to own is inspected.

- When possible, attend the home inspection so that you can see any damage yourself and ask questions.

- While you will get a detailed report, having an in-depth discussion with the home inspector before receiving the report will give you a better understanding of any current or potential issues.

- Every house has flaws but try to focus on what repairs must be done and if there are any dealbreakers for you.

- A good inspector will walk you through their findings with a thorough report. It may be long and seem overwhelming but understand that they are supposed to document every single issue, no matter how small.

- Your inspector and your agent will be able to help you distinguish which issues are hazardous, time-sensitive, costly, and/or red flags. Don’t be afraid to ask any questions you may have. Utilize their expertise.

Once you have all of the information in front of you, weigh the costs of potential and needed repairs and discuss worst-case scenarios. That way, if you proceed with purchasing the home, you are fully aware of what issues you may need to address right away and down the road. Of course, surprise costs can still come up when it comes to home repairs, but at least you’re able to gather as much information as possible through a detailed inspection.

For more information about the home buying process, check out our Guide to Buying a Home (PDF).

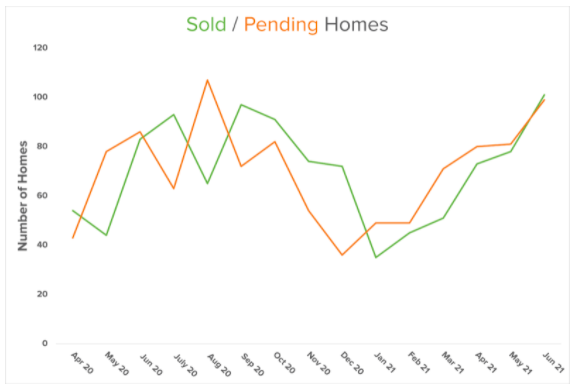

Second Quarter Market Review for North Kitsap

Our North Kitsap market performed even better than expected during our second quarter. We’ve compiled key highlights so that you can easily stay informed about our local real estate market.

Our Strong Seller’s Market

North Kitsap’s inventory remains low and demand remains high. Many people are continuing to move out of bigger cities in part due to the remote working culture. There are still many eager buyers and fewer sellers. Our Brokers continue to experience situations where some buyers are outbid either by price or by an all-cash offer in this competitive market.

If you look at the last five quarters detailed in the graph below, you can see that growth trends in volume continue to rise, even when comparing 2020’s second quarter to 2021’s second quarter. And, our market is definitely heating up this summer.

We’re continuing to see even higher prices. As you can see below, the listing and sale price divergence is shrinking now, as sellers benefit from our inventory shortage, asking for higher prices. Many buyers are able to meet this demand and we’re still seeing low mortgage rates.

Market Insights from Matthew Gardner

In his most recent Monday with Matthew, our Chief Economist, Matthew Gardner, begins with the staggering fact that “prices have risen almost three-fold, as the cost to finance has dropped by 72%.” If the number sounds too good (or bad) to be true, that’s because it is. To get an accurate picture, you also have to factor in inflation. Gardner explains that “just like other goods and services, the price of a house today is not directly comparable to the price of that same house 30 years ago because of the long run influence of inflation.” When you adjust for inflation, the rise in housing prices becomes less drastic. Without adjusting for inflation, “prices have risen by 268%”. But when you adjust for inflation, the “real prices have increased by 83.6%”. Therefore, the increase is much lower than what most people are discussing today.

Matthew also compares mortgage payments, another important piece of the puzzle. Although, without adjusting for inflation, “mortgage payments have increased by 74.3%,” the inflation-adjusted “real payments are 10.7% lower!” Of course, there are other monthly payments associated with home ownership. This includes property taxes, which do not change with market fluctuations. But this still indicates “that prices have been able to rise so significantly because mortgage rates have dropped”. It’s also because “inflation-adjusted home prices really haven’t skyrocketed – contrary to popular opinion.”

However, Matthew clarifies saying, “there are some markets across the country where the picture isn’t quite as rosy. In these places, prices have risen significantly more than the national average.” The Seattle metropolitan subunit (which extends around our local area) is one of these places. This is largely due to the increasing affluence as a result of the tech boom.

Not a Housing Bubble

Gardner’s bottom line is this: “there are quantifiable reasons to believe that we are not in a national housing bubble today.” However, he does point out that some markets will see a slowdown in price growth given “where prices are today in concert with the spectre of rising mortgage rates.” Ultimately, it’s still a strong seller’s market with an overall low supply and high demand. We expect to continue to see issues with affordability as prices and mortgage rates continue to climb.

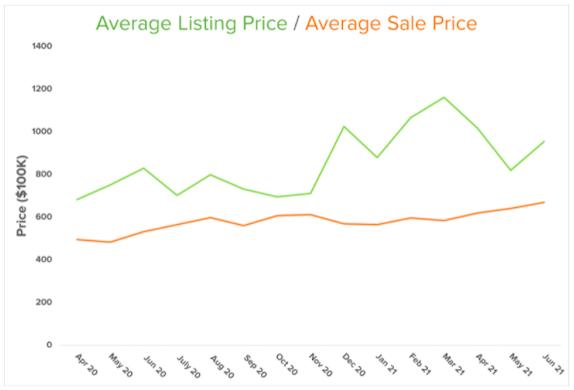

First Quarter Market Review for North Kitsap

Poulsbo’s North Kitsap market picked up in our first quarter despite a seasonal slowdown. We’ve compiled key highlights so that you can easily get informed about our local real estate market.

Our Strong Seller’s Market

North Kitsap’s inventory remains low and demand remains high due to people moving away from the bigger cities and COVID-19 changing the way we work. There are still many eager buyers outnumbering sellers. Our Brokers continue to experience situations where some buyers are outbid either by price or by an all-cash offer in this competitive market.

If you look at the last five quarters detailed in the graph below, you can see that a similar growth trend in volume is repeated when comparing 2020’s first quarter to 2021’s first quarter. Get ready for the market to continue to heat up as we move from spring to summer.

With our low supply, we may see even higher prices. This strong seller’s market is driving us toward an affordability ceiling. As you can see below, there’s a growing listing and sale price divergence. Sellers continue to benefit from our inventory shortage. Prices may soon be too high for some people to afford to buy a home here.

Affordability Issues and Market Insights

Matthew Gardner, Windermere’s Chief Economist, continues to track this affordability ceiling in his most recent Housing and Economic Update: “If the pace of home price growth continues, many households will start to be priced out” of what people can actually afford. As Gardner points out, we need more supply, and we need home prices to drop to alleviate this market strain.

Unfortunately, that might not happen fast enough for many hopeful homebuyers to make their dream a reality. Gardner reminds us that the cost of materials, recent storms, and the current housing market prices have all added to the cost of building new homes. This, in turn, will add to the listing price.

Additionally, Gardner points out that mortgage rates have risen after “a jump in bond yields has led rates to spike” as the country re-opens and economic activity increases. The resulting potential inflation causes the 10-year treasury interest rates to rise in hopes of attracting more buyers. However, it is still far below standard rates and shouldn’t be a concern for buyers right now.

Ultimately, it’s still a strong Seller’s Market with an overall low supply and high demand. We expect to continue to see issues with affordability as prices continue to climb.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link