2024 Interior Design Trends

The experts have weighed in and 2024’s interior design trends are all about embracing colors and fabrics that add warmth and texture. Eco-friendly ideas will also continue to play an important role in our living spaces. Read on to gain tips and inspiration to enhance your living space.

A Peach Perfect Color of the Year

PANTONE selected 13-1023 Peach Fuzz as the 2024 Color of the Year, which provides a soft, warm glow. If you’re new to interior design trends, the PANTONE Color of the Year is an educational program that began in 1999. It was created to celebrate the design community. Additionally, their detailed selection process involves analyzing global trends, encompassing art, design, fashion, and socio-economic influences. Leatrice Eiseman, Executive Director of the Pantone Color Institute, said in a statement, “In seeking a hue that echoes our innate yearning for closeness and connection, we chose a color radiant with warmth and modern elegance. It’s a shade that resonates with compassion, offers a tactile embrace, and effortlessly bridges the youthful with the timeless.”

We think this pretty pinkish hue would be a great addition to any living room or bedroom through peach accent pillows and/or a cozy throw blanket. Additionally, these taper candles would brighten any dining room. This printed tablecloth in apricot also aligns with the color of the year, as do these table lamps.

Embrace Warm Neutrals

While interior design trends still speak to the beauty of a bold accent color, warm neutrals are very in right now and can be used throughout your home. Warm neutral paint colors help soften brightly lit spaces and provide a welcoming, cozy vibe. More specifically, experts have predicted a return of warm whites to homeowners’ color palates. Additionally, many interior design professionals have spoken about the return of browns. Whether it’s brown walls or wood furniture, this neutral color can connect us back to nature. Check out these beautiful reclaimed wood tables from Crate & Barrel. This modern farmhouse wood mantel adds a touch of rustic charm.

When it comes to applying the interior design trend of using brown in your home, interior designer Alison Palevsky offers this tip: “Light brown tones make a brilliant backdrop for any space because you can layer materials such as metal, wood, fabric or paint all in the same neutral family. If the space you’re designing remains mostly neutral in color, adding even the smallest amount of pattern or texture will show it off.” Interior designer Heather Goerzen suggests using warm color combinations in your home. For instance, Goerzen suggests using neutrals with pops of brown and brick red. Alternatively, Goerzen likes a camel, brown, or marigold hue paired with cool accent colors, like green and blue.

Interior Design Trends that Use Bold, Dark Colors

Attention-grabbing dark colors can pair nicely with a lighter, neutral color. Professionals in the interior design world are also highlighting the use of bold, dark colors. First, the paint brand Behr chose Cracked Pepper as their color of the year. Then, paint brand Benjamin Moore chose Blue Nova 825, as their “it” color. These colors can really accentuate specific areas of your home. Perhaps either one would be perfect for a new accent wall. Or, consider a dresser makeover DIY project that uses one of these bold colors.

Add Texture to Your Home

Texture and textiles are enhancing living spaces in 2024. Boucle furnishing accent pieces and fluted cupboards can really make your home feel more inviting. Additionally, patterns are really popular. Think terra cotta tiled flooring and geometric wallpaper.

Environmentally Sustainable Pieces

Interior designers are also focusing more on how and where products are made. Handmade pieces and those that are made sustainably are adding a unique touch to interior spaces. Many consumers are more willing to invest in products and furniture that are eco-friendly and can withstand multiple uses. For ideas and inspiration, Architectural Digest published a useful guide explaining how to shop for sustainable furniture.

More Info & Inspiration

For more helpful tips and inspiration, check out our Q & A with Poulsbo interior designer Kristin Alvarado. Additionally, this Martha Stewart article can jumpstart your next painting project. Check out these design trends from The Spruce for other ways to incorporate earthy tones, bring the outdoors in, and more.

Staging a Home: Costs and Benefits

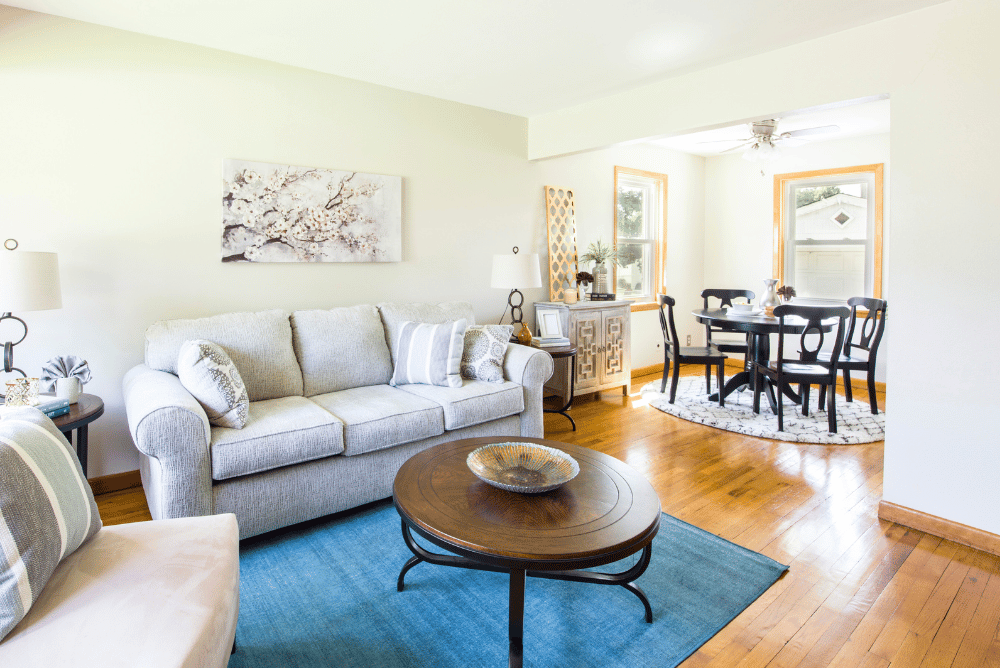

When it comes to selling your home, it’s essential to stand out to ensure the best price with the most favorable outcome. One effective way to do that is by staging your home. Staging will present your home in the best possible manner, appealing to homebuyers online and in person. Let’s explore the costs and benefits of home staging.

The Costs of Home Staging

Staging a home is an investment, and it’s important to understand the potential costs involved. The expenses can vary depending on the size of your home, the extent of the staging required, and your location. Here are some typical costs to consider:

- Professional Staging Services: According to data from HomeAdvisor, home sellers pay between $778 and $2,851 in home staging costs. However, the price can vary widely depending on how much staging needs to be done, if your home is vacant or not, and how big it is. How long your home is on the market also impacts the cost due to monthly furniture rental fees.

- Furniture Rental: If your home is vacant, you may need to rent furniture and decor to create a warm, inviting ambiance. Furniture rental costs can range from a few hundred to a few thousand dollars per month.

- Repairs and Updates: Sometimes, staging involves making necessary repairs or updates to your property. This may include fresh paint, minor updates, or landscaping improvements. Costs can vary, and a local expert will be able to assess your property’s specific needs.

- Storage Costs: If you need to store some of your belongings while your home is staged, you’ll need to consider storage costs.

- Utilities and Maintenance: While your home is on the market, you’ll need to keep your staged home in excellent condition. This may require additional utility expenses, as well as regular maintenance costs.

If you need financial assistance preparing your home, the Windermere Ready Program has benefitted many of our sellers. We can provide up to $100,000 and the program includes a personal consultation with one of our local real estate agents, high impact updates, and professional staging.

Why Sellers Should Stage Their Homes

Now that we’ve discussed the costs, let’s dive into the compelling benefits of staging your home:

- Faster Sale: Homes that are professionally staged tend to sell faster than unstaged properties. According to the National Association of Realtors (NAR), staged homes spend 73% less time on the market on average.

- Higher Selling Price: Staging can potentially increase your selling price. According to the National Association of Realtors, a 2021 report found that 85% of staged homes sold for 5% to 23% over the listing price.

- Improved First Impressions: Staging helps create a memorable first impression, making your home more attractive to potential buyers. An inviting and well-organized home can go a long way. In a 2023 study, 81% of buyers’ agents said staging a home made it easier for potential buyers to visualize the property as a future home.

- Increased Visibility: In today’s digital age, most homebuyers start their house hunt online. Staged homes typically photograph better, making your online listings more engaging. A captivating online impression can lead to increased clicks on your listing and increased foot traffic at open houses.

Why Use a Local Real Estate Agent

To ensure the successful staging of your Western Washington home, we highly recommend partnering with a knowledgeable, local real estate agent. Here’s why:

- Market Expertise: Our local agents understand the intricacies of Kitsap County’s real estate market. They know what buyers want and will tailor the staging process accordingly.

- Professional Network: Our experienced agents know excellent stagers, contractors, and other professionals who can assist.

- Pricing Strategy: Our real estate agents will help you determine the optimal pricing strategy for your staged home, ensuring you get the best return on your investment.

- Negotiation Skills: When it comes time to review offers, you want someone who will serve as your trusted advocate, using their negotiation skills to secure the best possible deal for you.

In conclusion, the benefits of staging a home far outweigh the investment. A well-staged home sells faster and at a higher price, and partnering with a highly-rated, local real estate agent ensures success. So, if you’re looking to sell your home in this beautiful corner of the Pacific Northwest, feel free to contact us with any questions you may have.

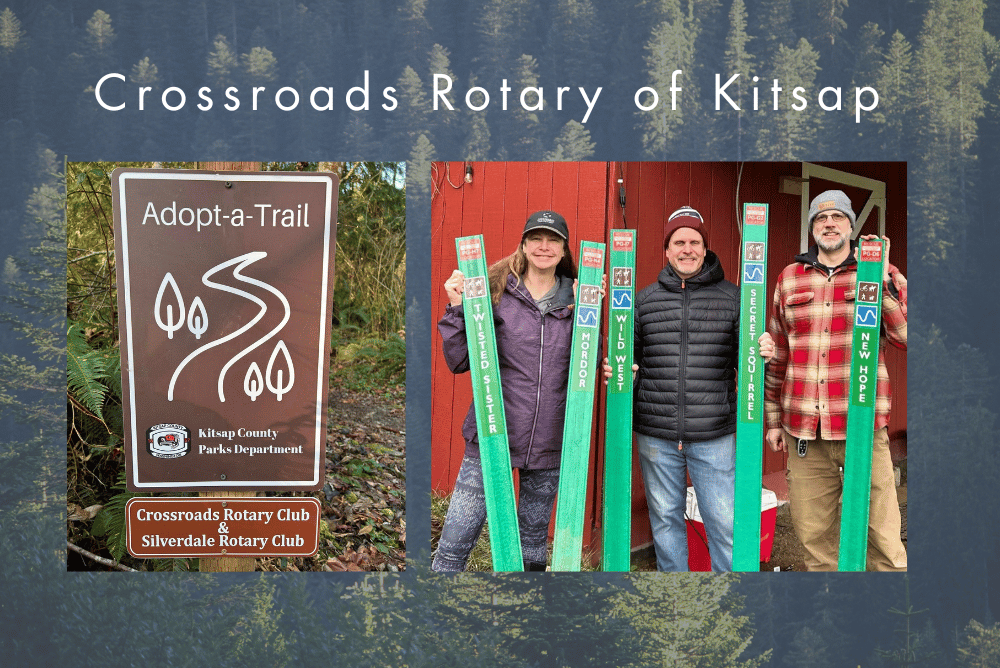

Crossroads Rotary of Kitsap: Improving Our Parks and Trails

If you have enjoyed a walk in a local park lately, chances are you have a volunteer to thank for making the experience more enjoyable. With tens of thousands of acres of parks and trails in Kitsap County, volunteer groups and “adopt a trail” programs are what make maintaining them all possible. Crossroads Rotary of Kitsap is one of the local groups stepping up.

Port Gamble Trail Project

Port Gamble’s “Bluff Trail” was previously managed by the North Kitsap Trails Association, but was adopted by the Crossroads and Silverdale Rotary clubs. They have assisted Kitsap County Parks in installing three new benches and expanding the parking lot. The Bluff Trail winds along the shoreline of Port Gamble Bay, just south of town. It is the former location of one of the oldest roads in Kitsap County. In fact, you can see remnants of the old road along the path. The Bluff Trail is part of the Port Gamble Forest Heritage Park, a large preserve with just shy of 3,500 acres of multi-use trails, including a haven for mountain bikers. The Evergreen Mountain Bike Alliance – West Sound Chapter is another integral organization for trail conservation. Near the Bluff Trail at the water’s edge, you’ll find an access point to the Kitsap Peninsula National Water Trails system.

Want to help with this trail project? Crossroads’ next work party at the Bluff Trail is Saturday, September 23rd from 9:00 AM to noon. All are welcome.

Other Park Projects

Crossroads members also volunteer at Raab Park and Fish Park, which are managed by Poulsbo Parks & Recreation. At Raab Park, Crossroads has done work parties to clear invasive plants from the dog park area and clean up the sports courts. Additionally, plans are in the works for a new trail. It will connect two existing trails on the west side of the park. This trail “intersection” will be appropriately named the “Crossroads Trail” and will complete a loop around the park.

At Poulsbo’s Fish Park, Crossroads Rotary helps out with the general cleanup of invasive weeds and trail maintenance. More substantially, they have been replacing worn-out, non-slip treads along the boardwalks through the woods. Thanks to them, more of us can safely enjoy the trails regardless of the weather.

More about Crossroads

Crossroads is part of Rotary International which has 1.4 million members with 46,000+ clubs around the globe. One of the main missions of the organization is “Service above self”. This is echoed in the selfless work that is done in and for our communities. Founded in 2019, Crossroads Rotary’s name points to the club’s location and the geography of its founding members. It is “located at the crossroads to Kingston, Bainbridge Island, Silverdale, and Poulsbo”.

Get Involved

While many Rotary clubs meet in the morning or during lunchtime hours, which can be hard with work schedules and/or children, Crossroads meets at 6:00 PM every 2nd and 4th Wednesday of the month. You’ll find members in the back room of Western Red Brewing in Poulsbo. If you are interested in learning more about the Crossroads Rotary Club of Kitsap, you can visit their Facebook page or attend a meeting as a guest.

Looking for other ways to get involved in our community? Check out other wonderful nonprofit organizations like the Poulsbo Historical Society, Kitsap Community Foundation, and Fishline Food Bank. There are so many rewarding ways to get connected and give back.

Family Fun on Whidbey Island

Whidbey Island is the perfect spot for families looking for a fun day trip or weekend getaway. The island is about 40 miles long and is a popular destination amongst locals and those visiting the Pacific Northwest. It only takes a couple of hours to get to Whidbey Island from Kitsap County, and Whidbey is about an hour and 15 minutes from Seattle.

Getting to Whidbey Island

If you’re going from Kitsap County to Whidbey Island, you’ll most likely drive and then ferry over. The Port Townsend/Coupeville ferry takes about 35 minutes and drops visitors off on the northern end of the island. Most ferries are loaded on a first-come, first-served basis, but we recommend making a vehicle reservation for the Port Townsend/Coupeville ferry. Alternatively, the Mukilteo/Clinton ferry is ideal to visit the southern portion of the island. The crossing time is about 20 minutes. If you drive around from the Seattle area, you’ll get to cross the picturesque Deception Pass Bridge.

State Parks Galore

Celebrated for its natural beauty, Whidbey Island offers many ways to spend time in nature. Deception Pass State Park is the most visited state park in Washington for good reason. Between the biking, equestrian and hiking trails and the popular Cranberry Lake, visitors are in for a treat. Cranberry Lake also has a dedicated swimming area, which is ideal on hot summer days.

Another popular destination is Ebey’s Landing Reserve. It offers kids and family programming as part of an active working partnership with local farms. The reserve also houses three state parks within its borders: Fort Ebey, Fort Casey, and Ebey’s Landing State Park. Exploring the forts and hiking along their bluffs makes for an unforgettable experience.

Visit Whidbey’s Unique Communities

Whidbey Island has three major cities: Oak Harbor, Langley, and Coupeville. Oak Harbor is the largest city on the island and is home to a number of restaurants and shops. It is also the closest city to the Naval Air Station Whidbey Island (NASWI). The city co-hosts an annual Military Appreciation Picnic in September and you can learn more about the military history of the area at the Pacific Northwest Naval Air Museum.

Langley is a quaint waterfront city on the southern end of Whidbey Island. It hosts the Island Shakespeare Festival, which runs performances from mid-July to mid-September. Home to many artists and studios, you and your family can enjoy a First Saturday Art Walk and delve into the Langley art scene. Langley Whale Center is also a fun place to explore. You can view the whale sightings map, check out whale skulls, and listen to orcas in the listening booth.

Coupeville lies in the heart of Ebey’s Landing Reserve. It is the second oldest town in Washington and hosts many fun festivals throughout the year. Coming up in October is The Haunting of Coupeville – a great way to get into the Halloween spirit. You and your family members may also enjoy Haunted Fort Casey State Park. Other popular festivals in town include a MusselFest in March and an annual Water Festival in May that features annual tribal canoe races and dance performances.

Food & Drink on Whidbey Island

Whidbey has a variety of wonderful restaurants, coffee shops, wineries, and breweries. Check out this interactive map of popular restaurants on Whidbey Island and the neighboring Camano Island. While it’s hard to pick just a few great restaurants, Front Street Grill in Coupeville has excellent mussels and cioppino. The Braeburn in Langley is a delicious spot for breakfast and lunch, and Honeymoon Bay Coffee Roasters in Oak Harbor has great coffee and pastries. You can also enjoy local eats by visiting one of the local farmers’ markets. For a family-friendly place to grab a bite and a pint, check out Flyers Restaurant and Brewery in Oak Harbor. They’ve won many awards, and they’re dog-friendly. If you’re looking for a kid-friendly winery, Holmes Harbor Cellars is a family-owned, award-winning winery in Greenbank. They welcome kids and pets, and have igloos and cabanas to enjoy.

However you decide to spend a day or weekend on Whidbey Island, we hope you and your family have a wonderful time. And, if you fall in love with Whidbey and want to stay a little longer, check out this helpful Whidbey Island Guide, created by our friends at Windermere Real Estate Whidbey Island.

Made in Kitsap: Locally Made Home Goods

Transform your space from house to home by shopping for these locally-made products. Kitsap has got you covered for all your household needs, from larger items like custom furniture and wallpaper to small touches that enhance a room. Skip the big-box stores and support these fantastic small businesses next time you want to improve your space or need the perfect host gift.

Wallcoverings and Textiles

Designed in Poulsbo, Abnormals Anonymous offers stunning prints. The creators describe their prints as “drawn from nature’s oddities and designed to spark curiosity, infused with coastal, floral, and wildlife motifs.” Abnormals Anonymous has a variety of wallpapers, grasscloths, and textiles designed locally and manufactured in the United States. You can see their work in Poulsbo’s new Hotel Scandi.

Furniture Made in Kitsap

Have you been dreaming of a specific piece of furniture that you can’t find anywhere else? Experts in both traditional woodworking and modern Architectural Millwork, Phenom Woodworks specializes in custom residential and commercial work that includes non-traditional materials – making every project truly one of a kind. Based in Poulsbo, Phenom Woodworks combines Swiss precision with globally inspired design. The team thrives on challenging projects and loves finding creative solutions to bring your visions to life.

For raw-edge tables or handcrafted rocking chairs, check out Laeradr Millworks, also in Poulsbo. Additionally, they have a wide selection of hand-turned bowls and wall hangings. They’ve even designed unique wall-mounted arcade systems for high-end game rooms.

For the Kitchen and Bathroom

For these frequently-used rooms, it is all about the details. Kitsap does not disappoint when it comes to locally-produced products. F.R.O.G. Soap in Bremerton is known for its beautiful bar soaps and body products. Additionally, they have laundry and dish soaps, locally-made pottery, and other home goods. Point Unbroken, which you can find on Bainbridge Island, has a full line of hypo-allergenic soaps, lotions, salves, candles, and cleaning products. Poulsbo’s Away With Words Bookshop offers house-made lotions, sugar scrubs, and Cupcake Candle Company candles crafted in Sequim. Away With Words also features Frantic Art’s handmade ceramics, which are made in Kitsap but were only available at Pike Place Market until this year.

For pottery made in Kitsap, check out Fern Street Pottery. You can find it at many shops across Kitsap County, including Nordiska in Poulsbo, Danger on Bainbridge Island, and the Indianola Country Store. Fern Street is best known for mugs, barware, and serving items.

To check out various local home goods, visit the Poulsbo Farmers Market. We’re proud sponsors of the Poulsbo Farmers Market, and you’ll find wonderful vendors such as The Rustic Cedar Co., which creates laser-engraved cutting boards, and Secret Garden Lavender from Seabeck for all things lavender. Another local favorite at the market is Sea Wind & Fog, which has Pacific Northwest-inspired soy wax candles and diffusers.

For Your Pantry

If you want to fill your pantry with local goods, Spiva Spices in Silverdale specializes in spice blends and rubs. Also, Tea & Spice Exchange in Poulsbo carries various spices, salts, flavored sugars, and many teas. Kingston’s CB’s Nuts has great nut butters and roasted nuts. Crimson Cove in Poulsbo carries locally-smoked salmon, cheese, nuts, and preserves. Get your coffee fix with freshly roasted beans from Grounds For Change or Caffe Cocina, both in Poulsbo.

If these locally-made goods have inspired you to spruce up your home even more, check out our recent Q&A with local designer Kristin Alvarado.

Want to Sell Your Home? Avoid These Mistakes

If you want to sell your home, it’s important to prepare in every way – and that includes avoiding pricey missteps. Selling a home involves various fees and costs. However, it also involves opportunities to maximize your profit. In order to have the best home-selling experience, avoid these costly and timely mistakes.

Not considering home-selling costs

There are many costs associated with selling a home. Prior to listing, remember to take into account the price of a pre-sale inspection and the listing agent’s fees. In addition, getting your home ready for sale may require repairs and/or staging.

After selling the home, there will be the remainder of the mortgage to pay, escrow fees, and property taxes. Additional taxes may apply to your unique situation, such as the capital gains tax. Finally, factor into your budget the cost of moving. You may need to hire movers, rent a moving truck, or find a storage unit during the interim period.

Not preparing your house for sale

While there will be fees and costs associated with moving, there are ways to guarantee your home is sold for its highest possible price. First and foremost: prepare your home for the market. Ordering a pre-listing inspection and discussing it with your real estate agent can help you decide what repairs will have the highest return on investment. As a result, the pre-listing inspection and repairs will often lead to a much smoother transaction.

Also, staging a home often results in the home being on the market for a shorter period of time. An expertly staged home instantly entices buyers, shows off the property’s best features, and helps them easily see themselves living there. Additionally, staging often leads to a home selling at a higher price point. The investment in repairs and staging can make a significant impact. A turnkey or move-in ready home drives sales. Sure, preparing to sell your home is an investment of time and resources, but it is a powerful revenue-generating task.

Not using a local real estate agent

A knowledgeable, local real estate agent can have a profoundly positive affect on the home-selling process. According to the National Association of Realtors, a good local Realtor will understand the specifics of the market you are selling in, have access to greater search power and offer objective opinions to maximize your home’s value. While some may try the “for sale by owner” approach, working with a local real estate agent offers many benefits. Utilize their expertise to maximize your efforts. A trusted advocate will have your back when it comes to negotiations, they’ll project manage for you, and you’ll have access to their network of excellent local vendors to get the job done right.

Not getting a CMA

One value a real estate agent can provide is a free CMA. A CMA is a Comparative Market Analysis. It is a comprehensive report that compares your property to others in the area. After walking through the home to get a general idea of its condition, the real estate agent will look at similar homes that have sold in your area. The agent will also consider local market trends and seasonal factors, as well as the location of the home.

The value of the report lies in its ability to ensure a home is priced to sell. In addition, the report can give insight into what upgrades and repairs are the most cost-effective to maximize a home sale.

Not taking advantage of home-selling programs

A distinct advantage of working with Windermere is its amazing program for home sellers. The Windermere Ready program is designed to help sellers make an excellent first impression with potential buyers. It provides the home seller with a personalized assessment and consultation with a Realtor to identify custom priorities for updating and repairing the home.

This personalized assessment takes the guesswork out of selling a home and allows the owner to maximize their profits with strategic updates and planning. Many Windermere agents and their clients have found great success with this program, as demonstrated in the video below.

Not waiting to sell

Generally speaking, it is better to hold onto a home for as long as you can. However, unexpected moves, family priorities, and job opportunities are some of the many common reasons a homeowner may decide to sell. Many may wonder: is two years enough time to wait before selling a home?

This is when it is important to consider the selling fees mentioned above. Closing costs, agent commissions, and taxes may not make selling the home a profitable financial decision. It’s also important to keep in mind that a home sold before two years have passed is subject to capital gains tax. Ensure you look at all the numbers before selling your home to ensure it has appreciated enough to cover closing costs.

The general rule of thumb is that it typically takes five years for it to make financial sense to sell a home.

Not accepting the best offer

Sometimes the best offer does not come from the highest bid. It’s important to discuss all the terms of the offer with your real estate agent. Cash offers or buyers who are pre-approved by a lender may be likely to close the deal on time.

In addition, go over all the contingencies laid out in the offer. Take into consideration the offer’s proposed deadlines and timelines. Look at all components of the offer to ensure it best meets your home-selling needs.

Selling a home can be a worthwhile endeavor financially. By avoiding these costly mistakes, you will be on the right track toward maximizing your home sale profitability.

Best Hot Springs in Western Washington

Some of the best hot springs in Western Washington are only a couple of hours from Kitsap County. Locals and tourists alike enjoy soaking in Washington’s natural beauty. From deep in the Middle Fork Snoqualmie Valley of the Cascade Mountains to the Elwha Valley of the Olympic Mountains, you can explore some of Western Washington’s beloved attractions.

Goldmyer Hot Springs

These are meant for the true wilderness enthusiast and adventurer. Goldmyer is only accessible by mountain bike or a 4.5-mile hike. And, lush forests and waterfalls treat visitors to a spectacular view along the way. The natural waters are the grand prize for those visitors willing to make the trek.

Reservations are strongly recommended because only 20 visitors are allowed per day. They are privately owned and operated by Northwest Wilderness Programs, a nonprofit organization. Learn more about how to make reservations.

Olympic Hot Springs

These pools were once home to the majestic Olympic Hot Springs Resort. However, they are no longer maintained or tested. The resort in the Elwha Valley in the Olympic Mountains is now closed. Thus, visitors are encouraged to use caution before entering the pools. They may contain harmful bacteria.

The Olympic Hot Springs is only accessible by foot. Road access is very limited in that area. Additionally, backpackers must obtain a wilderness use permit and follow all wilderness camping regulations. There is so much to explore in the Olympic National Park that many use these hot springs as a base camp. Just be sure to obtain an Olympic National Park Wilderness Permit.

Sol Duc Hot Springs Resort

The Sol Duc Hot Springs Resort is perfect for all ages, and it’s a fun weekend getaway. Enjoy this tranquil retreat by staying in a rustic cabin surrounded by evergreens. Additionally, included in the stay is access to the resort’s three mineral pools and one freshwater pool.

Prefer to visit for the day? The resort also offers reservations for the pools on a first-come, first-served basis, in person. What’s more, the water is tested in the mineral pools periodically, and visitors are encouraged to check the pool’s schedule.

Ready for More?

If you’re ready for other outdoor activities to enjoy here in Washington, check out our article on great places to go fishing and crabbing. Or, visit these fun farms here in Kitsap County.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link